Supplier: Ipsos Limited Partnership

Contract Number: CW2343098

Contract Value: $121,075.57 (including HST)

Award Date: December 20, 2023

Delivery Date: May 10, 2024

Registration Number: POR102-23

For more information on this report, please contact ROP-POR@crtc.gc.ca

Ce rapport est aussi disponible en français

This public opinion research report presents the results of an online and phone survey conducted by Ipsos Limited Partnership on behalf of the Canadian Radio-television and Telecommunications Commission (CRTC). The research study was conducted with 2,541 Canadians between February 14 to March 29, 2024, and constitutes the second wave of research in this area.

Cette publication est aussi disponible en français sous le titre : Suivi de la recherche sur l’opinion publique : Vague 2

This publication may be reproduced for non-commercial purposes only. Prior written permission must be obtained from the CRTC. For more information on this report, please contact CRTC at: ROPPOR@crtc.gc.ca or at:

Canadian Radio-television and Telecommunications Commission (CRTC)

1 Promenade du Portage

Gatineau, Quebec J8X 4B1

The Canadian Radio-television and Telecommunications Commission (CRTC)

Ottawa, Ontario

Canada

K1A ON2

Tel: 819-997-0313

Toll-free: 1-877-249-2782 (in Canada only)

Catalogue Number: BC92-129/2-2024E-PDF

International Standard Book Number (ISBN): 978-0-660-72689-2

© His Majesty the King in Right of Canada, as represented by the Canadian Radio-television and Telecommunications Commission, 2024.

Ipsos was commissioned by the Canadian Radio-television and Telecommunications Commission (CRTC) to conduct the second wave of public opinion research on Canadians views with respect to their broadcasting, online, and telecommunications services to compare results to the baseline research conducted in 2023.

The CRTC regulates the communications industry in the public interest in a time of significant socio-cultural, economic, and technological change and is looking to increase its capacity to measure and track Canadian public opinion to support new regulatory measures. The CRTC received new policy directions for a new telecommunications policy in February 2023, and a policy direction for the Online Streaming Act (Bill C-11) has been released. To address these policy directions, the CRTC will be required to develop new regulatory approaches and to ensure that they take into account the views of all Canadians.

To help accomplish this goal and following the success of the POR Tracker baseline pilot study conducted in 2023, the CRTC conducted a second phase of research. The POR report for the baseline wave of research can be found on the Library and Archives Canada (LAC) website. Moving forward, it is envisioned that the POR will be conducted on a bi-annual basis.

The second phase of the POR tracker sought to understand the views of Canadians with respect to their broadcasting, online, and telecommunications services. The survey was used to track issues of strategic importance to the CRTC, such as customers’ satisfaction with providers, affordability, importance of local media, trust in media, and cybersecurity.

As with the baseline wave, an essential component of the POR research was to ensure the inclusion and representation of all Canadians. Further, there was specific focus on ensuring sufficient participation from Anglophones, Francophones, Indigenous Peoples, Official Language Minority Communities (OLMC), Racialized Canadians, TSLGBTQ+, and those living in the North.

In developing the questionnaire, Ipsos worked with CRTC staff to synthesize and incorporate input from all relevant sectors. This included conducting a series of meetings with staff in the Broadcasting, Telecommunications, Compliance, and Enforcement (C&E), and Consumer, Research, and Communications (CRC) units.

The questionnaire included a core section of key tracking measures in order to make comparisons to the baseline research and sections to address more topical information needs that are custom to each wave of research.

The second wave of the POR survey addressed the following areas:

The POR was conducted through a quantitative survey executed through a mixed methodology approach including online and telephone interviews among a national sample of 2,541 Canadians aged 18 years and older (1,563 online, 978 telephone). Fieldwork was conducted from February 14 to March 29, 2024. Average survey length was 19 minutes (21 minutes online, 16 minutes by telephone). In order to ensure the ability to compare results between waves, methodologies between the baseline wave and the present research remained consistent.

Quotas and weighting were employed by gender, age, and region to reflect the composition of the Canadian general population based on the latest Census. Results were accurate to within + 2.2 percentage points of what the results would have been had every Canadian been polled.

Minimum sample sizes (of at least 100) were achieved among key audiences including Anglophones (n=1800), Francophones (n=513), Indigenous peoples (n=138), Official Language Minority Communities (OLMC) (n=144), racialized Canadians (n=759), and 2SLGBTQI+ (n=212). Oversamples of TSLGBTQ+ Canadians and those residing in the North were required and notably, fieldwork in the North continued to prove challenging and the target of n=100 could not be achieved in the fieldwork period (n=83 was achieved).

The contract value for the POR survey was $121,075.57 (including HST).

Few Canadians feel well informed about the CRTC's mandate and role. Impressions of the organization, while largely neutral to positive, are inhibited by limited familiarity. Those who feel more informed about the CRTC’s work have stronger, more positive impressions.

Canadians remain largely confident in their ability to pay for the telecommunications, broadcast or streaming services they receive, most notably for cellphone service or home internet. However, a higher proportion report making recent changes to their services to improve affordability compared to the baseline wave. Impressions that services are becoming less affordable over time, and that they have limited choice of providers, persist.

Most Canadians feel they can count on the telecommunications networks where they live. The vast majority have not experienced any major service distributions to the services they receive, however impressions have softened with respect to reliable high-speed internet compared to the baseline wave.

Canadians continue to consume media content primarily through video sources for both ‘entertainment’ and ‘news and information,’ followed by audio and other media sources. Impressions of the quality of content has decreased for nearly all sources compared to the baseline, and fewer Canadians express trust in the news media, express satisfaction with Canadian television programming, and feel reflected in content currently available.

More than half of Canadians report they often receive unsolicited emails, text and calls with malicious intent or have experienced a scam attempt either directly or indirectly, and prevalence of both have increased since the baseline. Most are confident in their ability to identify fraudulent communication, however, relatively few know how or where to report scams when they happen.

Political Neutrality Statement

I hereby certify as Senior Officer of Ipsos that the deliverables fully comply with the Government of Canada political neutrality requirements outlined in the Communications Policy of the Government of Canada and Procedures for Planning and Contracting Public Opinion Research. Specifically, the deliverables do not include information on electoral voting intentions, political party preferences, standings with the electorate or ratings of the performance of a political party or its leaders.

Brad Griffin

President

Ipsos Public Affairs

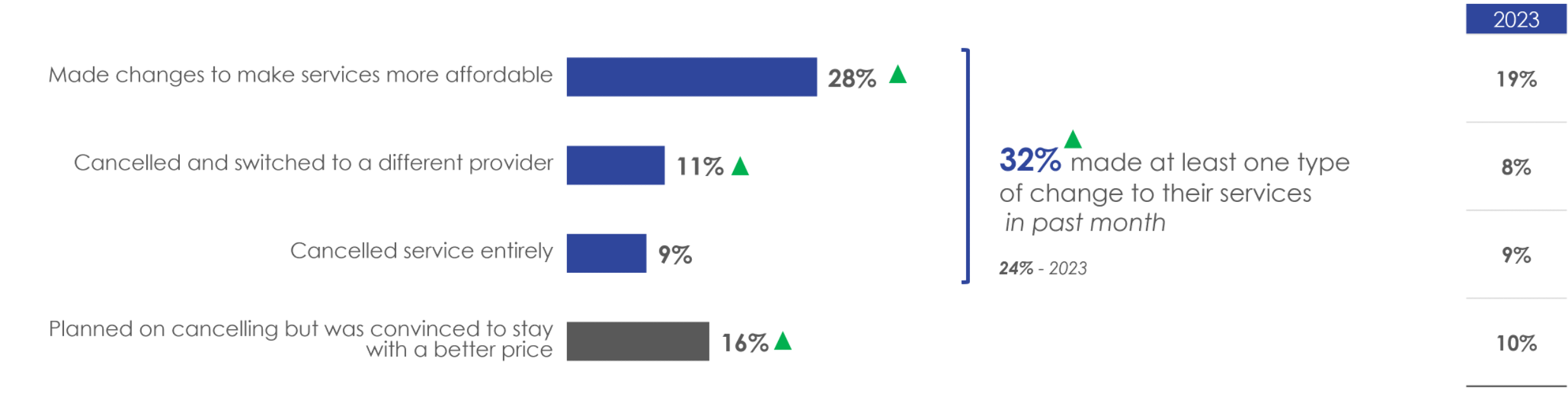

Among those who reported having telecommunications, TV, audio and/or video subscription services, roughly three in ten (32%) made some type of change to their services to improve the affordability in the past month. Nearly three in ten (28%) made changes in the past month to make their services more affordable, while one in ten cancelled and switched providers (11%) or cancelled their services entirely (10%). Sixteen percent (16%) planned on cancelling their service but were convinced to stay with a better price.

Compared to the baseline wave, a higher proportion of Canadians reported having made at least one type of change to make their services more affordable, and there has been an increase in those who made each specific type of change, except for cancelling their service entirely.

Figure 1: Changes made to services to make them more affordable (in past month)

Base: Those who have cable TV, satellite TV, internet, cellphone, video streaming and/ or audio streaming services (n=1548)

Q10. Thinking about the last month, have you or anyone in your household made changes to any of your cellphone, television and/ or streaming services to make them more affordable? This may include altering the services you receive, that you planned on cancelling but were convinced to stay with a better price, cancelling and switching to a different provider or cancelling the service entirely.

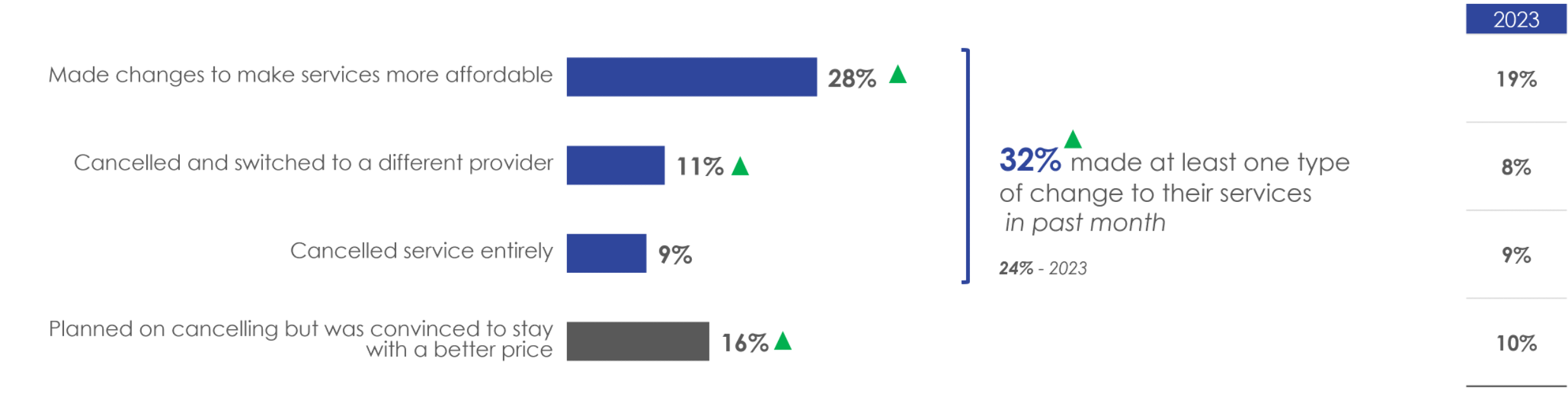

Among the 28% who made changes to make services more affordable, six in ten made changes to their cellphone service (62%), followed by home internet (41%), video streaming services (33%), cable TV service (22%), audio streaming services (26%), and satellite TV service (6%). Compared to the baseline wave, a higher proportion report having made changes to their cellphone service or their home internet.

Among the 16% who were convinced to stay with a better price, just over four in ten mention this was for home internet (42%), followed by cellphone (34%), video streaming services (32%), cable TV (24%), audio steaming services (26%), and satellite TV service (7%). Compared to the baseline wave, a higher proportion report that they had cancelled on cancelling their home internet connection but were convinced by their provider to stay with a better price.

Among the 11% who cancelled and switched to a different provider, one-third report this was for their cellphone service (30%), followed by video streaming services (29%), home internet (28%), audio streaming services (27%), cable TV (15%), and satellite TV service (5%). There have been no statistically significant shifts compared to the baseline wave.

Figure 2: Changes made by type of service(s)

Base: Those who made changes (n=423); planned on cancelling but convinced to stay (n=234); cancelled and switched (n=157)

Q11. Which of these services did you, or someone in your household, [‘make changes to’/‘plan on cancelling but were convinced to stay with a better price instead’/‘cancel and switch to a different provider’] in the last month?

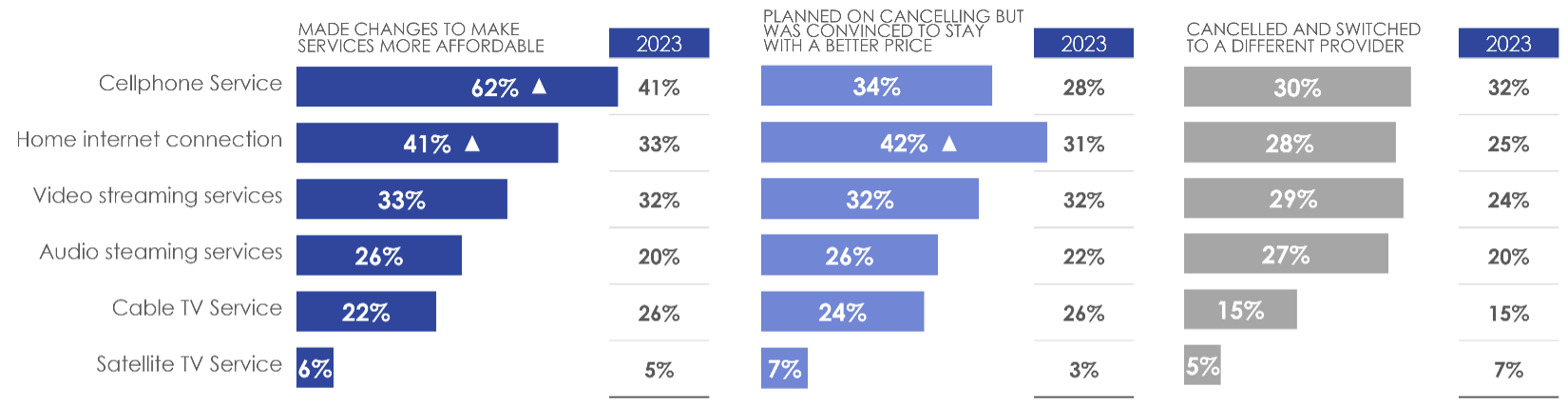

One in ten (10%) Canadians report having cancelled their cable TV service in the past month, 7% home internet, 6% cellphone or satellite TV service, and one percent or less report having cancelled their audio streaming services (1%) or video streaming services (0.3%). Compared to the baseline wave, a higher proportion of Canadians report having cancelled their home internet connection, while fewer report having cancelled their video or audio streaming services.

Figure 3: Cancellation of service entirely

Base: All answering (n=1563)

Q12. And, which of these services did you, or someone in your household, cancel entirely?

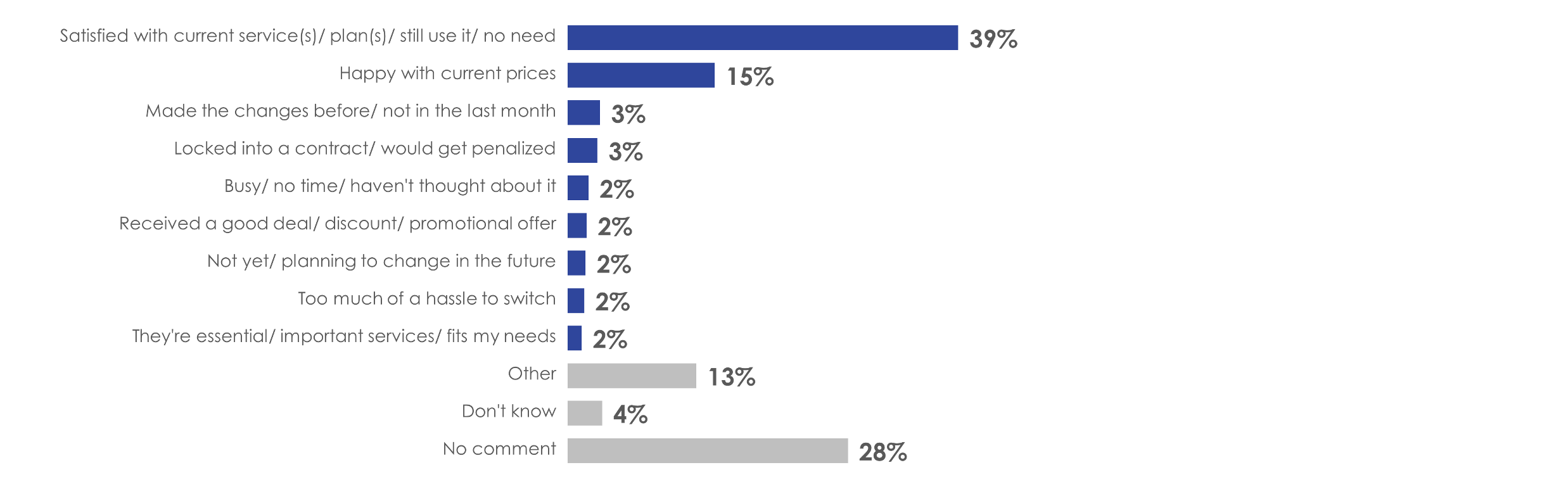

Among those who indicated they did not make any changes to their services in the last month, by far the most common reason why was because they are satisfied with their current service (39%), followed by that they are happy with their current prices (15%). A variety of other less prominent reasons were provided, of which the most common were because they changes made prior to the past month (3%) or are locked into their contract (3%).

Figure 4: Reasons for not making changes

Base: Did not change any services (n=1515)

Q13NEW. You indicated that your household has not made changes to one or more of the telecommunications, television, audio and/or video subscription services you receive in the last month. Why would you say you have not made changes to these services?

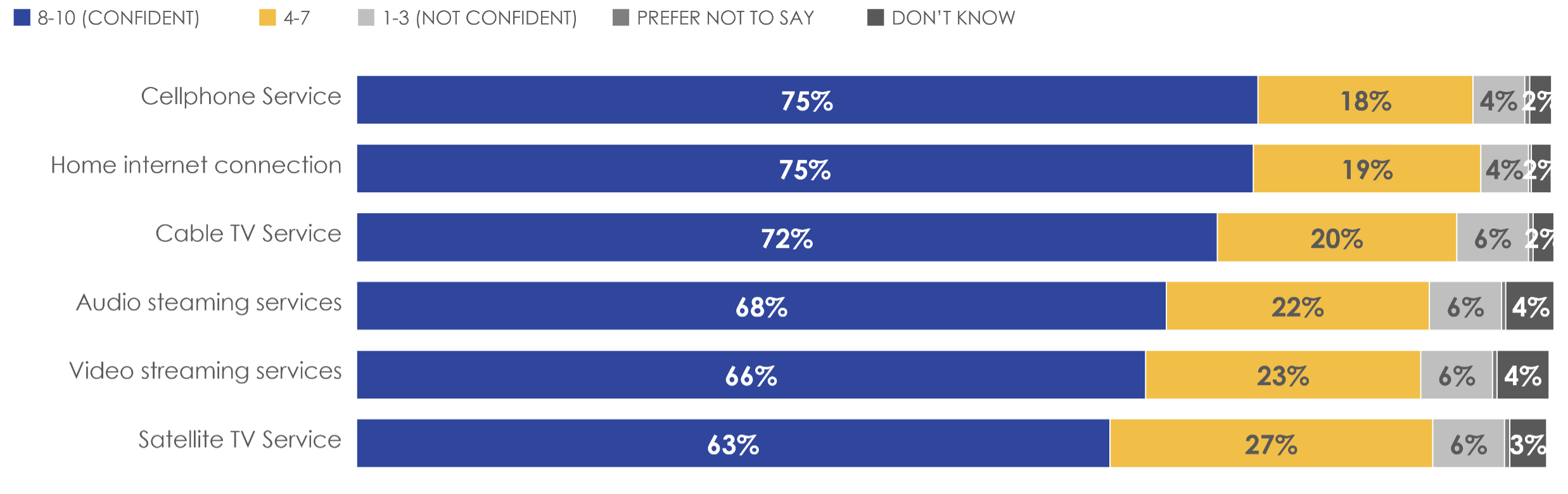

Among those who reported having each type of service, confidence in their ability to pay for their services without making any changes in the next three month was highest for cellphone service (75%) and home internet (75%), followed closely by cable TV service (72%). Closer to two-thirds expressed confidence in their ability to pay for their audio (68%) or video (66%) streaming services, or satellite TV service (63%).

Figure 5: Confidence in ability to pay by type of service

Base: Those who have cable TV, satellite TV, internet, cellphone, video streaming and/ or audio streaming services (n=varies)

Q14. How confident or not are you that you and your household will be able to pay for each of the telecommunications, television, audio and/or video subscription services you receive without making any changes in the next three months?

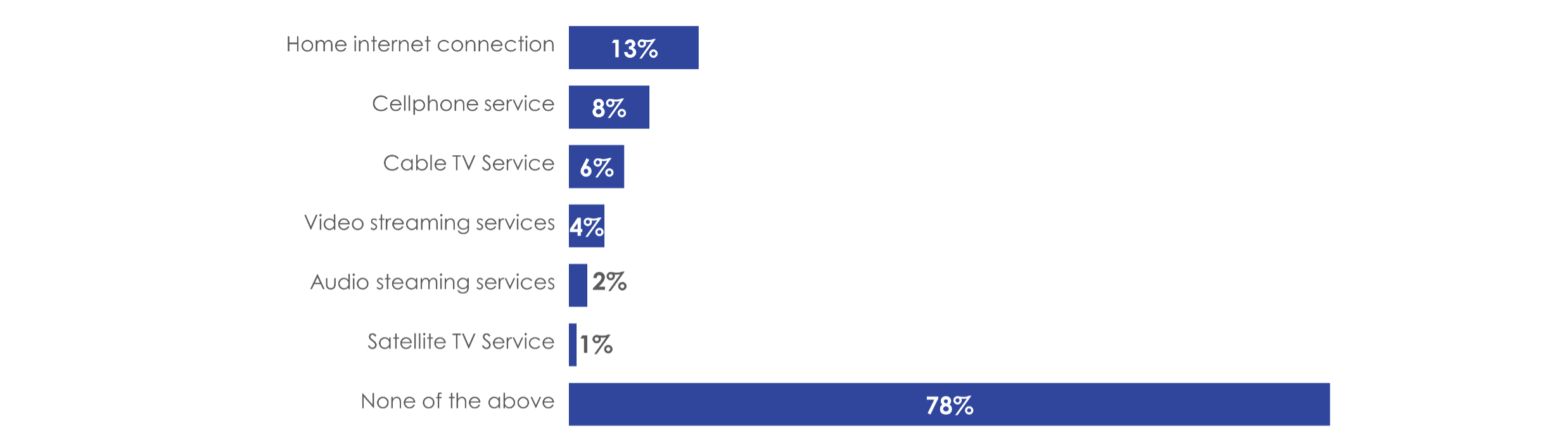

Nearly eight in ten (78%) reported not having experienced any major service disruptions lasting 24 hours or longer for any of the telecommunications, television, audio and/or video subscription services they receive. Just over one in ten said they have experienced a major service disruption to their home internet (13%), followed by their cellphone service (8%), cable TV service (6%), video streaming services (4%), audio streaming services (2%) or satellite TV service (1%).

Figure 6: Reported service disruptions

Base: All answering (n=1563)

Q14A.Have you experienced any major service disruptions lasting 24 hours or longer for any of the telecommunications, television, audio and/or video subscription services you receive?

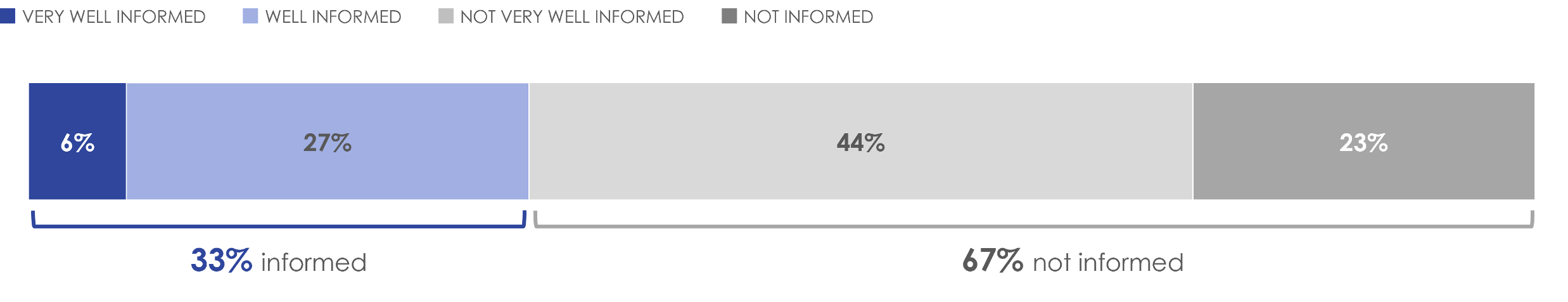

One-third (33%) of Canadians said they feel either well informed (27%) or very well informed (6%) about the mandate and role of the CRTC, while two-thirds (67%) reported they feel less informed including more than four in ten (44%) who said they are not very well informed, and one-quarter (23%) not informed at all.

Figure 7: Perceived understanding of CRTC’s role and mandate, unprompted

Base: All respondents (n=2541)

Q14B. Overall, how informed are you about the mandate and role of the Canadian Radio-television and Telecommunications Commission (CRTC)?

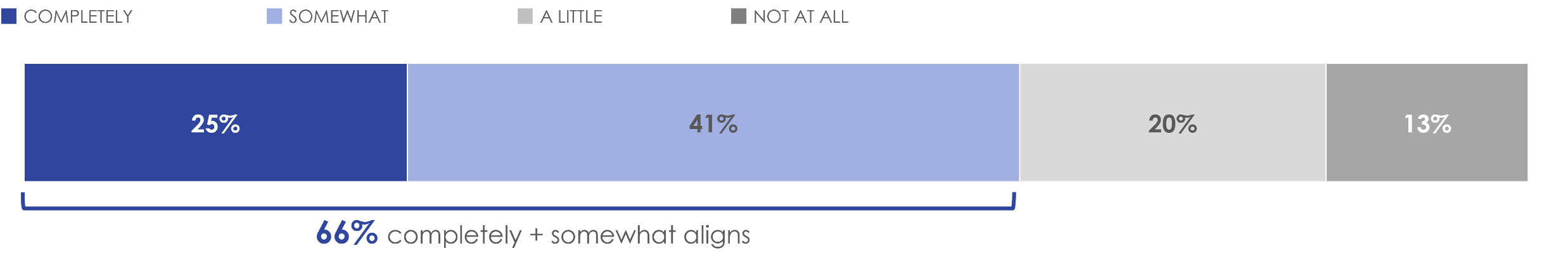

After being informed about the CRTC’s mandate, two-thirds of Canadians said they feel the description aligns with their understanding of the mandate and role of the CRTC including one-quarter (25%) who said it aligns completely and four in ten (41%) aligns somewhat. Two in ten (20%) felt the description provided aligns a little with their understanding, and roughly one in ten (13%) does not align at all.

Figure 8: Perceived understanding of CRTC’s role and mandate, prompt

Base: All respondents (n=2541)

Q14C. The Canadian Radio-television and Telecommunications Commission (CRTC) is an administrative tribunal that regulates and supervises broadcasting and telecommunications in the public interest. It is dedicated to ensuring that Canadians have access to to a world-class communication system that promotes innovation and enriches their lives. How closely does this statement align with your understanding of the mandate and role of the CRTC before taking this survey?

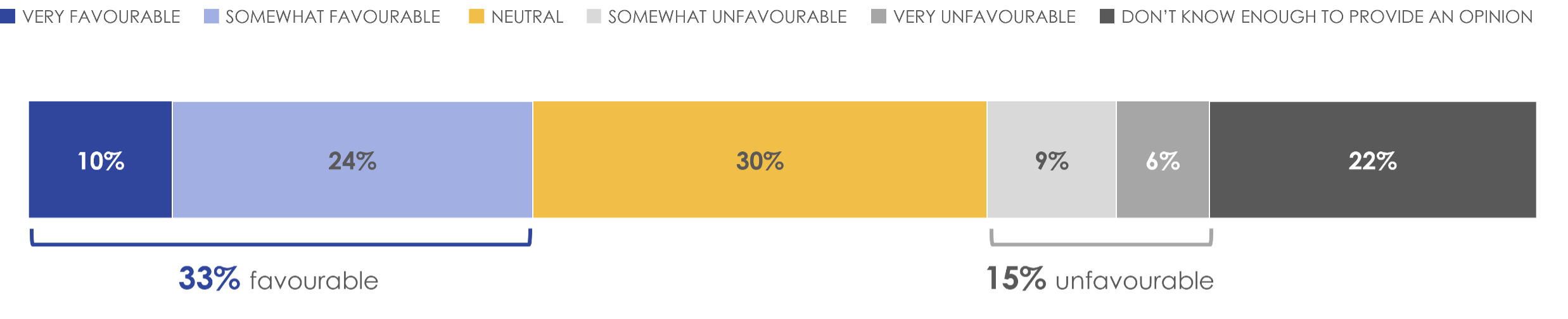

One-third (33%) of Canadians said they have a favourable impression of the CRTC (10% very/ 24% somewhat), three in ten (30%) were neutral in their opinion, while roughly one in ten (15%) were unfavourable (9% somewhat/ 6% very). Just over two in ten (22%) said they do not know enough about the CRTC to provide an opinion.

Notably, those who felt more informed about the mandate and role of the CRTC were more likely to express a favourable opinion of the CRTC (47%) than those who felt less well informed (27%) who were more likely to say they don’t know enough to have an opinion (29% vs. 6% among those who felt well informed/ very well informed).

Figure 9: Favourability of the CRTC

Base: All respondents (n=2541)

Q14D. What is your impression of the CRTC?

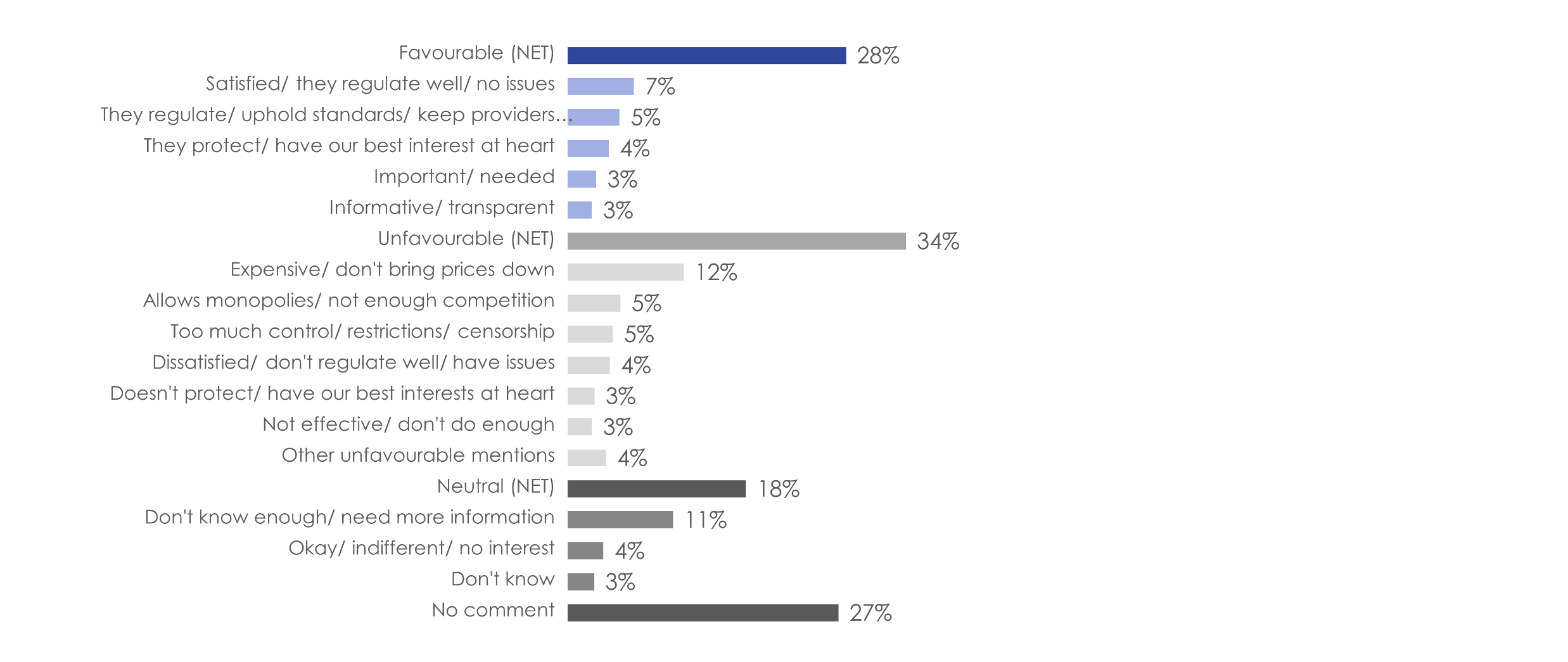

When asked to explain the reasons behind their opinion of the CRTC, comments were roughly evenly split between favourable mentions (28%), unfavourable mentions (34%) and those who don’t know or provided no comment (30%). The most common favourable comments included that they are satisfied/have no issues (7%), that the CRTC regulates well (5%), that it protects Canadians’ best interests (4%), that it is important (3%), and that it is informative/ transparent (3%). The most common negative comments included that things are expensive/that the CRTC does not bring prices down (12%), that the CRTC allows monopolies (5%), that there is too much control or censorship (5%), that they are dissatisfied/the CRTC does not regulate well (4%), that the CRTC does not protect Canadians’ best interests (3%), or that the CRTC is not effective (3%). Roughly two in ten (18%) provided neutral comments, including that they do not know enough to have an opinion/need more information (11%), or that they are indifferent (4%).

Figure 10: Reasons for opinion of CRTC

Base: Those with an opinion of the CRTC (n=2012)

Note: Coded mentions less than 3% not shown.

Q14E. You indicated you have a […] impression of the CRTC. Why do you say that?

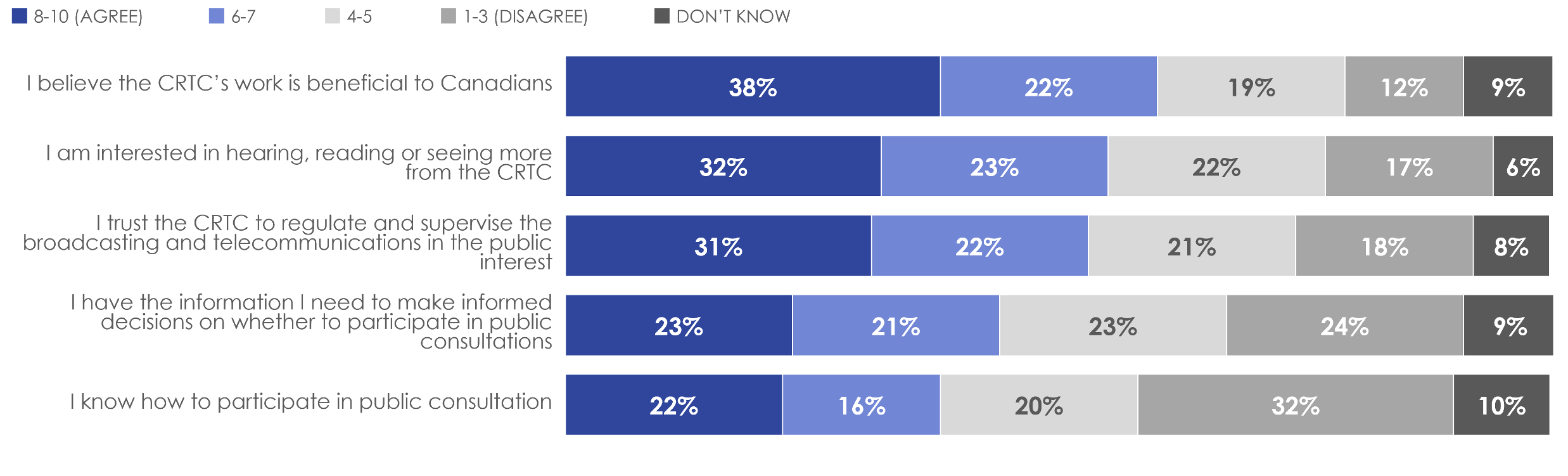

When asked their opinion on a series of statements related to the work of the CRTC, trust in the organization and engagement in public consultations, most Canadians expressed softer levels of agreement. At nearly four in ten (38%), Canadians were most likely to agree that the CRTC’s work is beneficial to Canadians, followed by roughly one-third who are interested in hearing reading, or seeing more from the CRTC (32%), and trust the CRTC to regulate and supervise the broadcasting and telecommunications in the public interest (31%). Around one-quarter (23%) agreed they have the information they need to make informed decisions on whether to participate in public consultations, and that they know how to participate in public consultations (22%), and notably a higher proportion disagree than agree to the latter statement. Around one in ten said they don’t know enough to provide an opinion for all statements.

Figure 11: Perceptions of CRTC work and public engagement

Base: All respondents (n=2541)

Q14F. To what extent do you agree or disagree with the following statements:

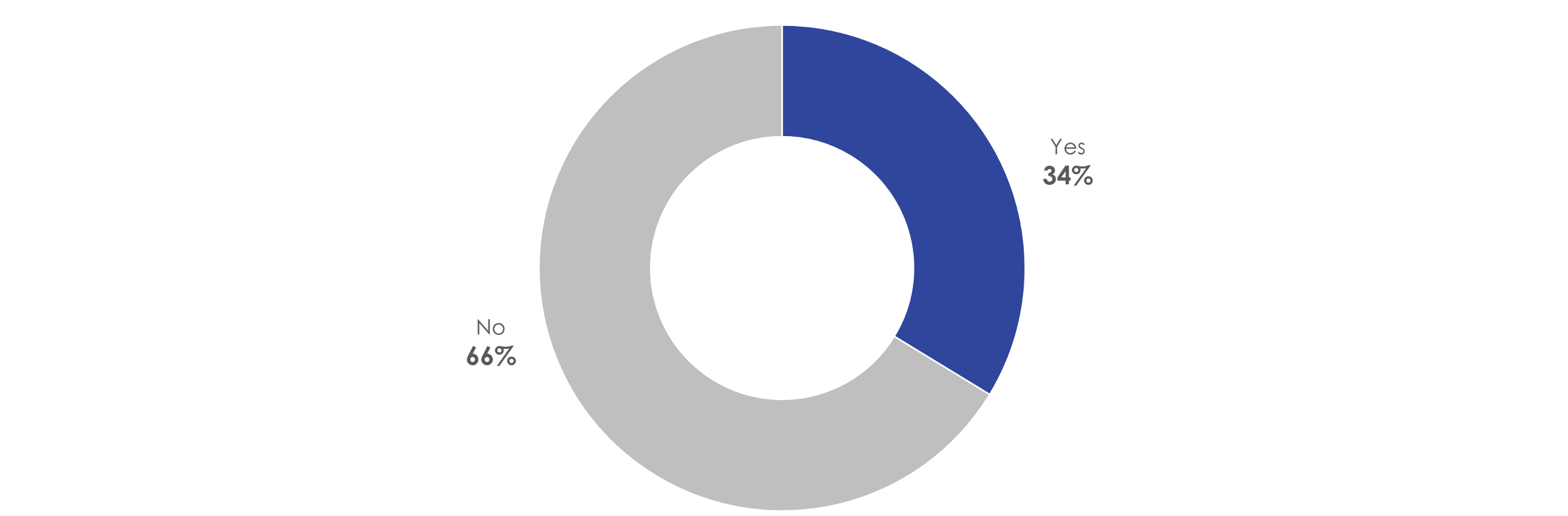

One-third of Canadians (34%) reported that they recall seeing or hearing something about the CRTC over the past year, while 66% say they do not. Those who said they recall seeing or hearing something about the CRTC were more likely to express an opinion of the organization in general, including a higher proportion with both favourable and unfavourable views, than those who did not. They were also more likely to agree to all statements related to the work of the CRTC, trust in the organization and engagement in public consultations.

Figure 12: Recall of seeing or hearing anything about the CRTC in last year

Base: All respondents (n=2541)

Q14G. Do you recall seeing or hearing anything about the CRTC over the past year?

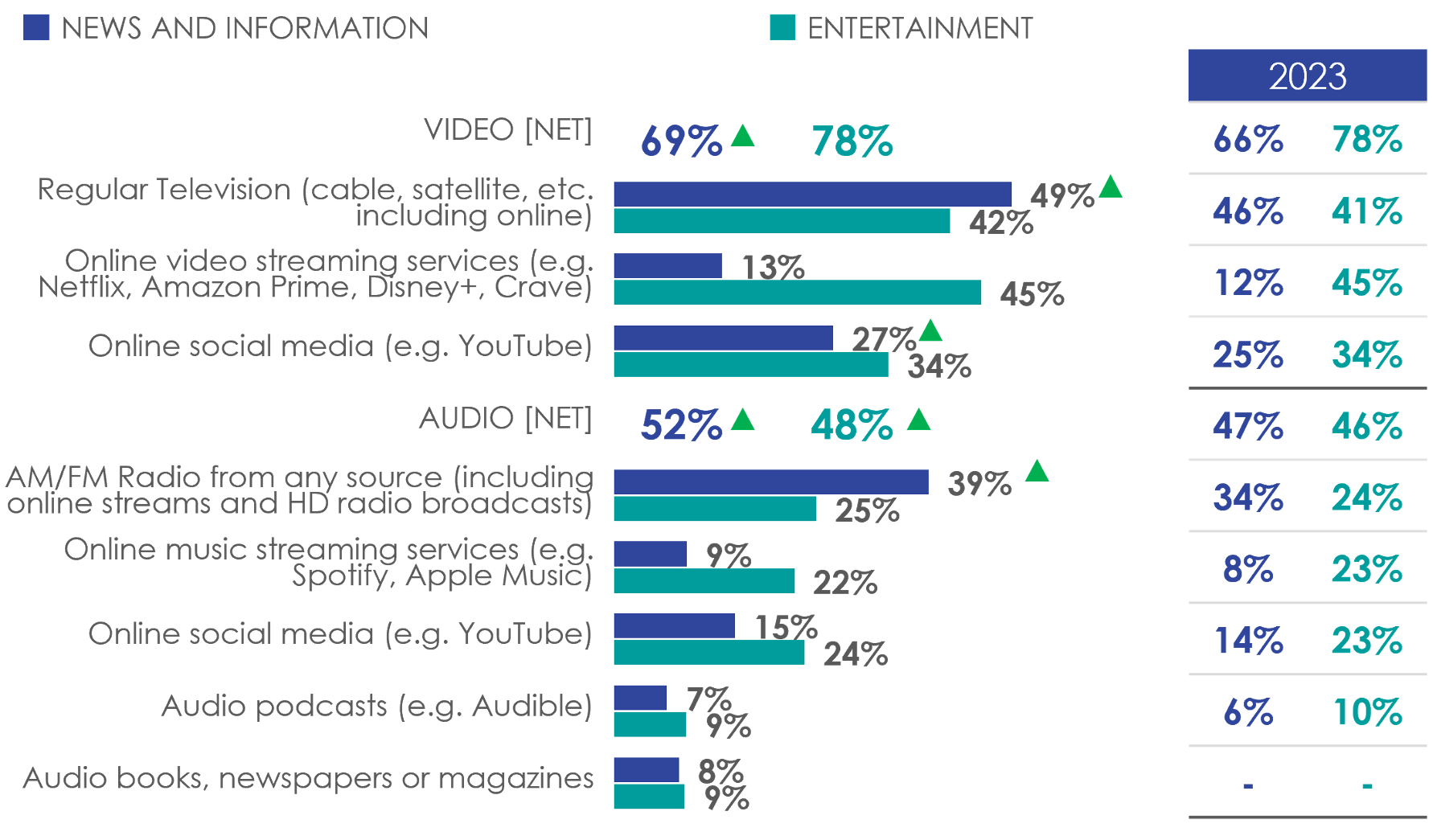

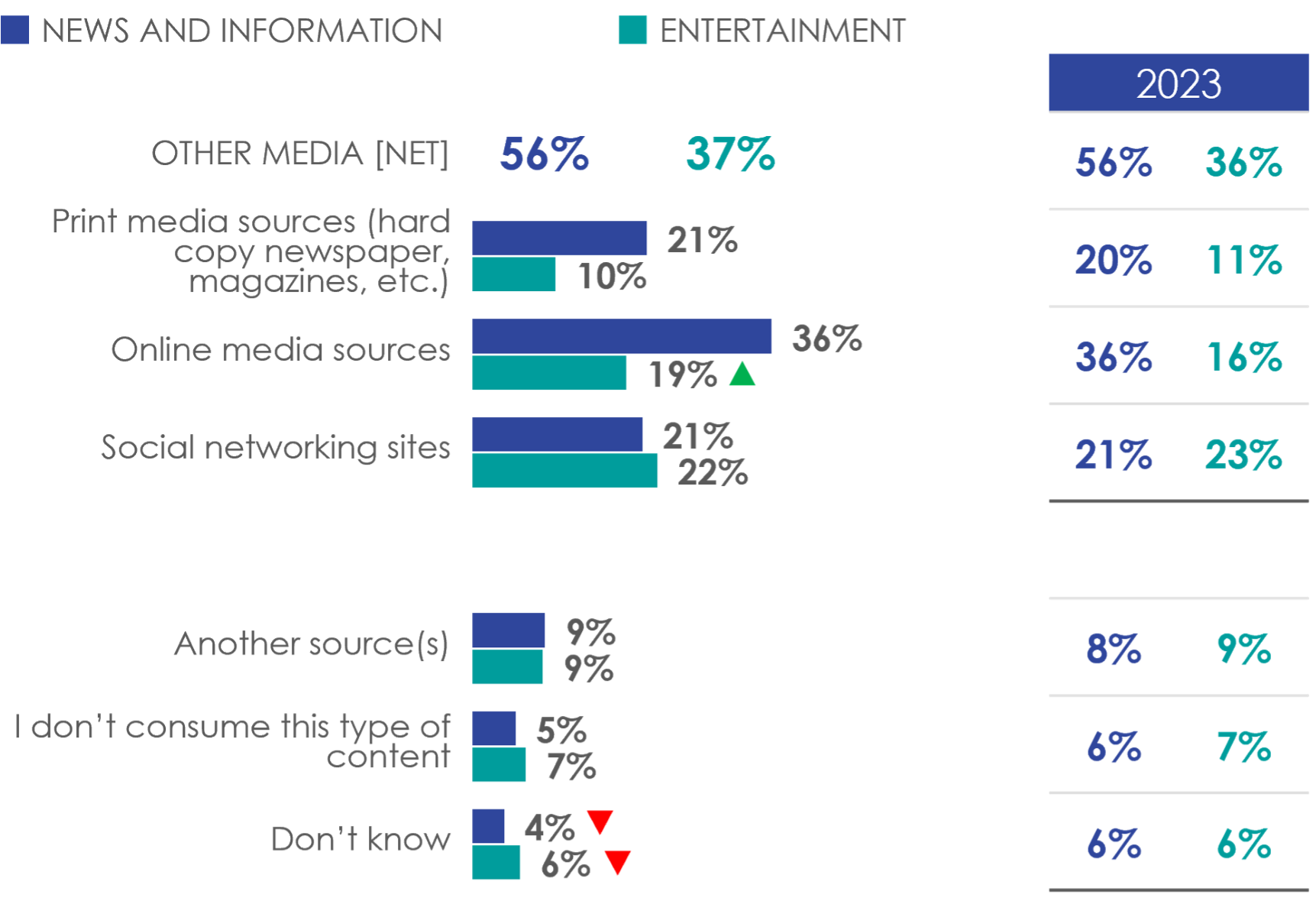

Canadians’ primary sources of media content for both ‘entertainment’ and ‘news and information’ continued to be video (78% and 69% respectively). Roughly half reported their primary sources for either type of content are audio (49% and 52%) and nearly six in ten (56%) said they use other media sources for ‘news and information’ compared to roughly four in ten (37%) for ‘entertainment’ content. Compared to the baseline wave, a higher proportion reported audio as their primary source for both ‘news and information’ and ‘entertainment’, and video as their primary source of ‘news and information.’

The most common sources of media content for ‘news and information’ continued to be regular television (49%), followed by AM/FM radio (39%), online media (36%), and online social media (27%). For ‘entertainment,’ the primary sources reported were also largely consistent with the baseline and include online video streaming (45%) and regular television (42%), followed by online social media (34%). Compared to the baseline wave, a higher proportion reported using regular television, online social media, and AM/FM radio for ‘news and information,’, and using online media sources for ‘entertainment’. Fewer said they don’t know what sources they use for both ‘news and information’ and ‘entertainment.’

Figure 13: Primary source(s) for ‘news and information’ and ‘entertainment’ content (1/2)

Base: All respondents (n=2541)

Q18. What are your primary source(s) of media content for ‘news and information’ and ‘entertainment’? Please select the most common source(s) you use for each.

Figure 14: Primary source(s) for ‘news and information’ and ‘entertainment’ content (2/2)

Base: All respondents (n=2541)

Q18. What are your primary source(s) of media content for ‘news and information’ and ‘entertainment’? Please select the most common source(s) you use for each.

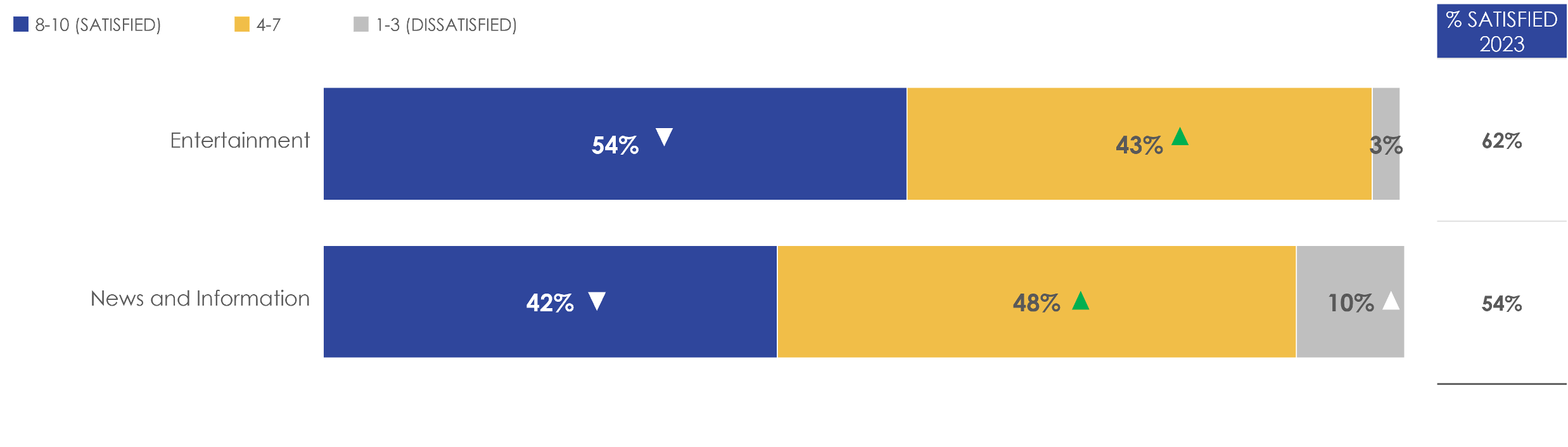

Among those who reported consuming each type of programming, over half (54%) expressed satisfaction with the ‘entertainment’ content they receive, while four in ten (42%) were satisfied with the ‘news and information’ content. Between four in ten and just under half expressed softer levels of satisfaction with either, while few were dissatisfied.

Compared to the baseline wave, fewer Canadians were satisfied with both ‘entertainment’ and ‘news and information’ content they receive, and a higher proportion expressed softer levels of satisfaction with either, and dissatisfaction with ‘news and information’ content.

Figure 15: Satisfaction with quality of content for ‘news and information’ and ‘entertainment’

Base: Those who consume ‘entertainment’ (n=2226) and/or ‘news and information’ (n=2301) content

Q19. Overall, how satisfied are you with the quality of content you receive for…?

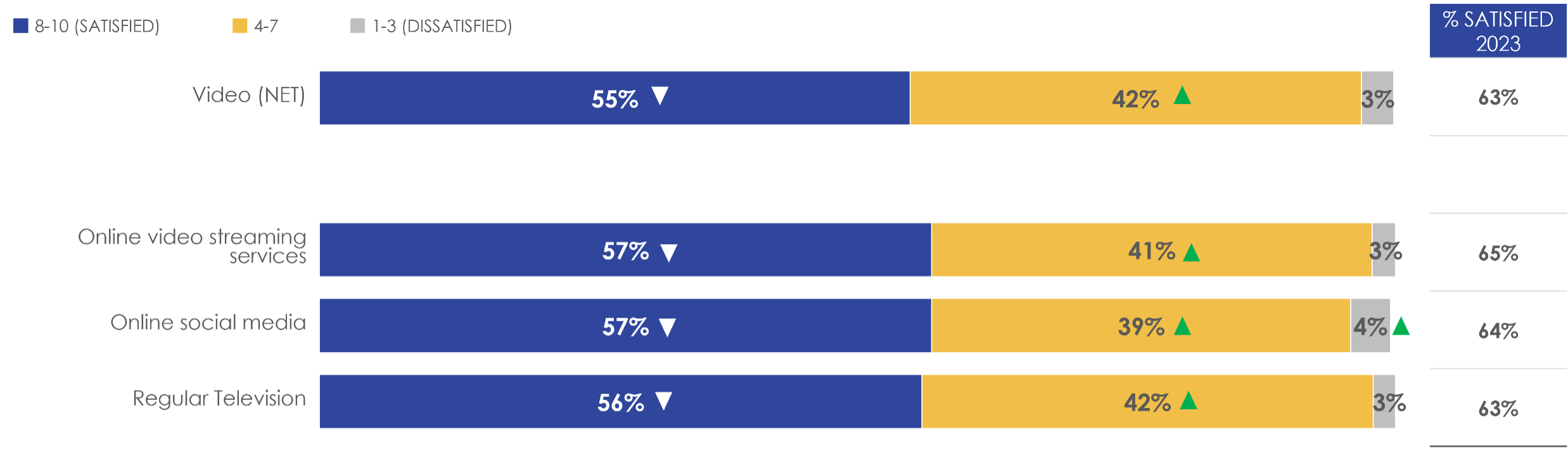

Over half were satisfied with the quality of ‘entertainment’ content they receive from video (55%), audio (55%), and other (53%) media sources.

Satisfaction was consistent by the type of video content they receive and just under than six in ten were satisfied with the content from online video streaming services (57%), online social media (65%) and regular television (56%). Compared to the baseline wave, satisfaction has declined for all types of video content, with more Canadians expressing softer views of each as well as a higher proportion who were dissatisfied with online social media.

Figure 16: Satisfaction with quality of content for ‘entertainment’ by video source(s)

Base: Those who consume ‘entertainment’ (n=2226) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

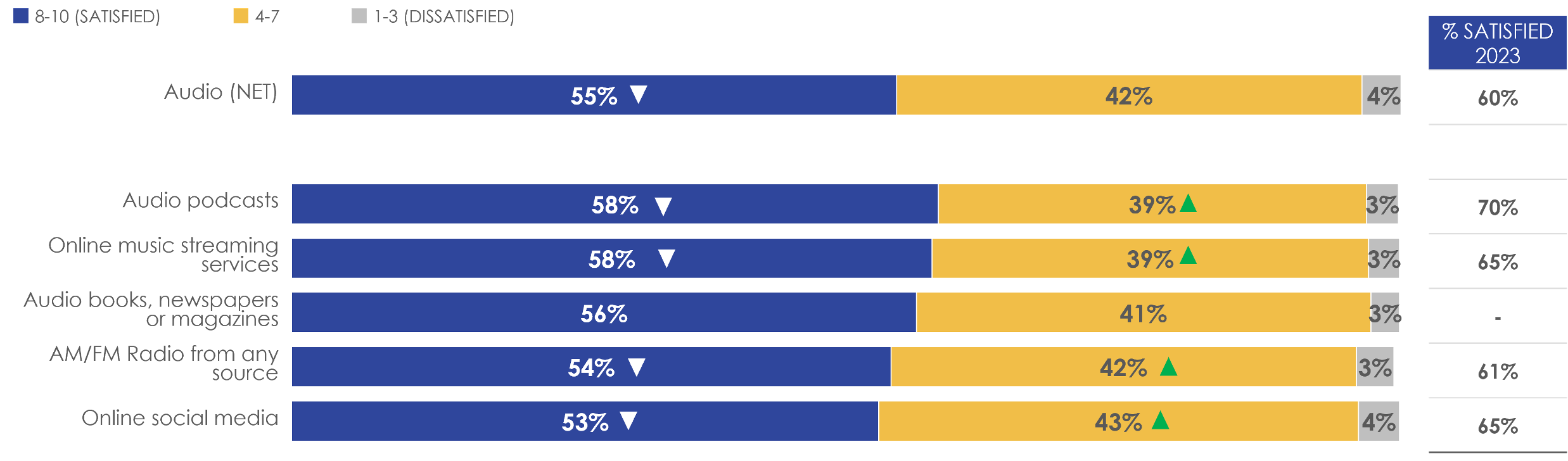

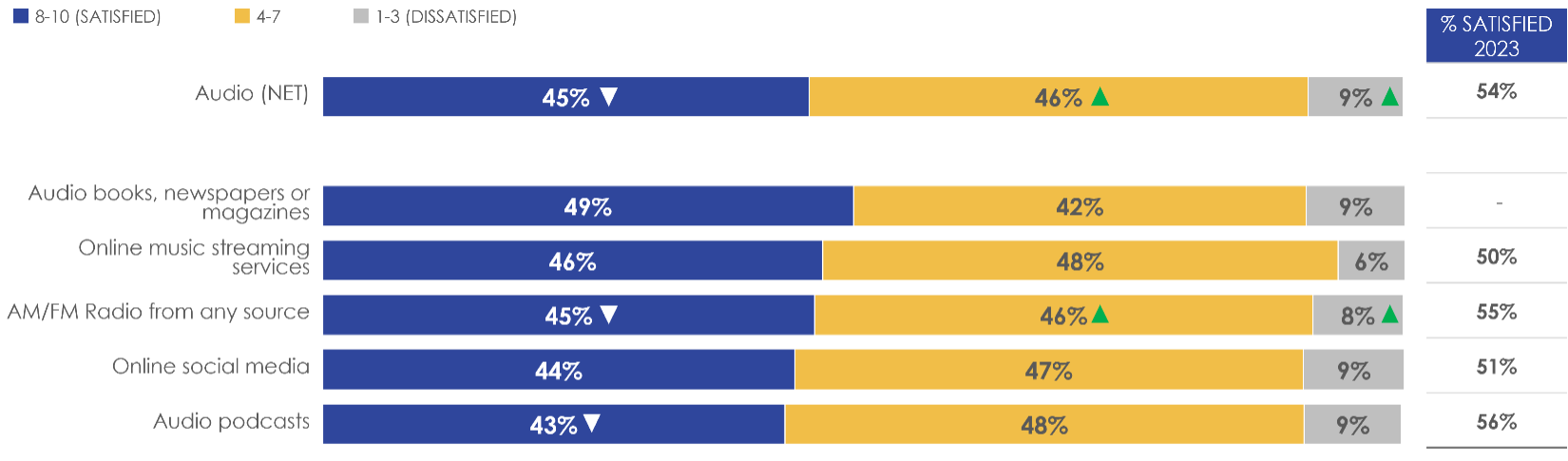

Just under six in ten were satisfied with the content from audio podcasts (58%), and online music streaming (58%), followed by audio books, newspapers, or magazines (56%), AM/FR radio (54%), and online social media (53%). Compared to the baseline wave, satisfaction has declined for all types of audio content, with more Canadians expressing softer views of each.

Figure 17: Satisfaction with quality of content for ‘entertainment’ by audio source(s)

Base: Those who consume ‘entertainment’ (n=2226) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

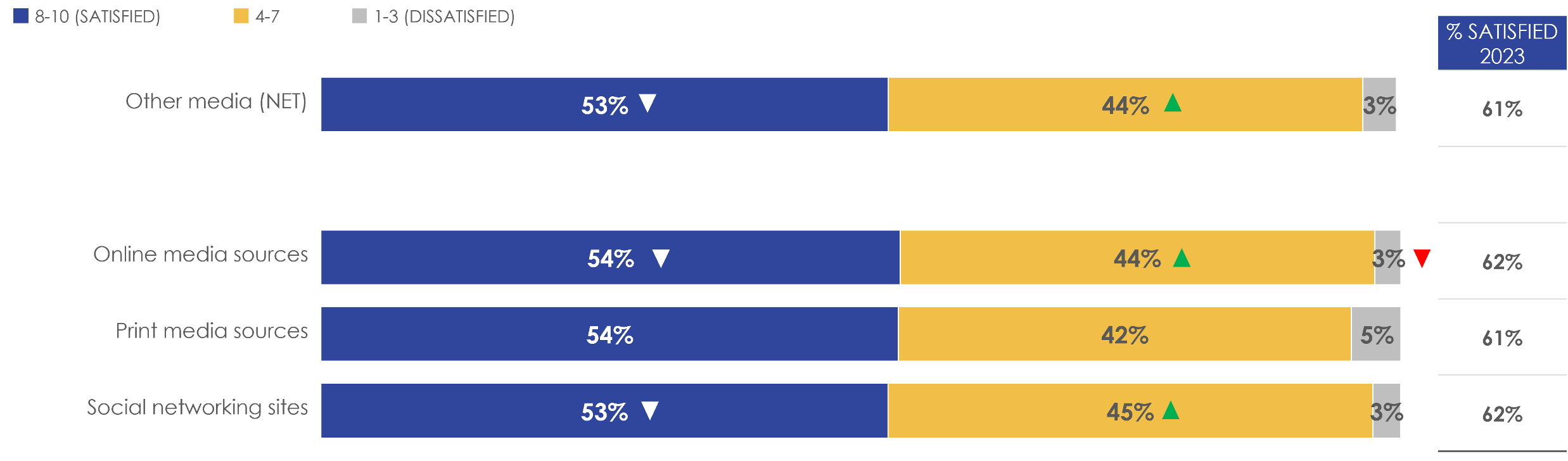

Satisfaction was consistent by the type of other media content and over half were satisfied with the content from online media (54%), print media sources (54%), and social networking sites (53%). Compared to the baseline wave, satisfaction has declined for most types of other content, with the exception of print media which has remained stable.

Figure 18: Satisfaction with quality of content for ‘entertainment’ by other media source(s)

Base: Those who consume ‘entertainment’ (n=2226) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

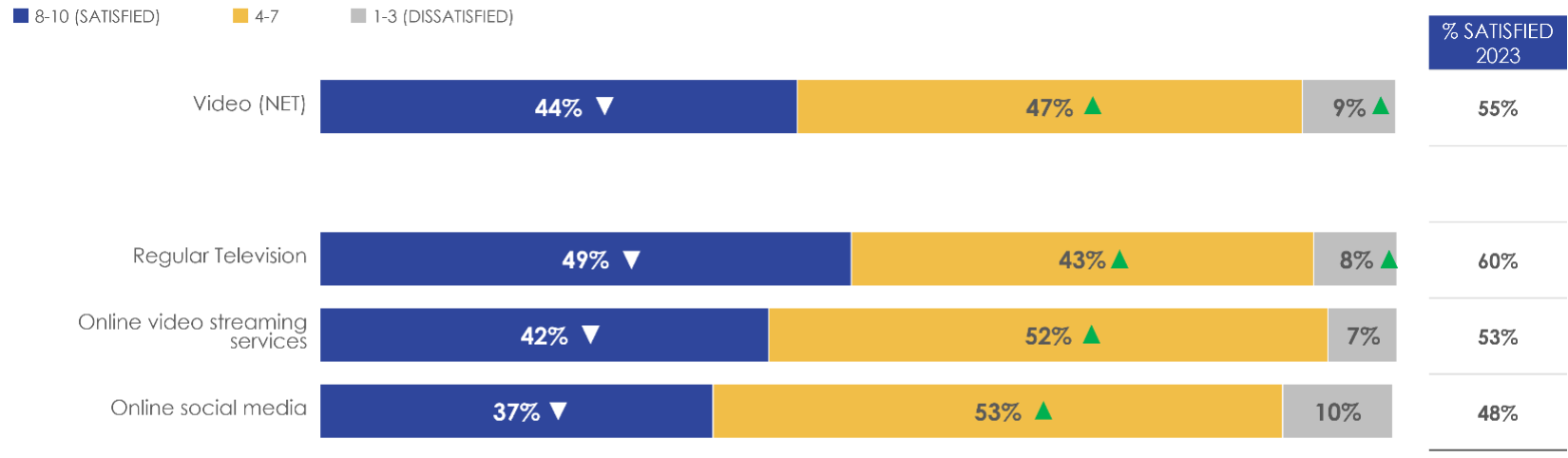

Just over four in ten were satisfied with the quality of ‘news and information’ content they receive from video sources (44%), audio sources (45%), or other types of media sources (43%).

Half were satisfied with the video content from regular television (49%), followed by roughly four in ten for online video streaming (42%) and online social media (37%). Compared to the baseline wave, satisfaction has declined for all types of video content, with more Canadians expressing softer views as well as a higher proportion who were dissatisfied with regular television.

Figure 19: Satisfaction with quality of content for ‘news and information’ by video source(s)

Base: Those who consume ‘news and information’ (n=2301) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

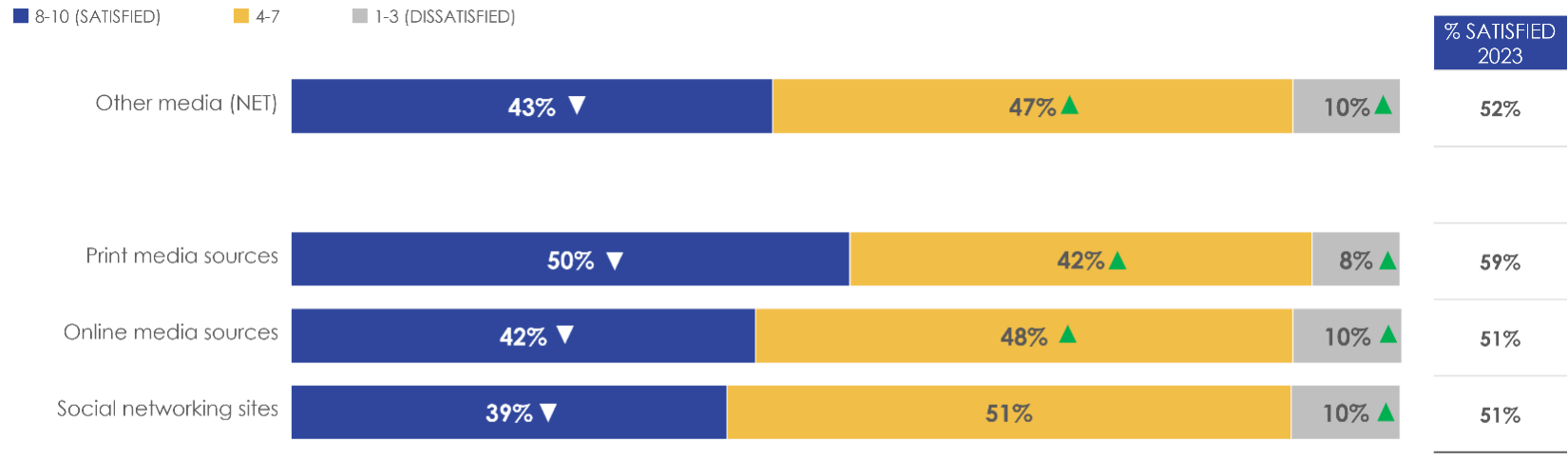

Around half were satisfied with the content from audio books, newspapers, or magazines (49%), followed by online music streaming (46%), AM/FM radio (45%), online social media (44%) and audio podcasts (43%). Compared to the baseline wave, satisfaction has declined for AM/FM radio and audio podcasts with more Canadians expressing softer views as well as a higher proportion who were dissatisfied with AM/FM radio.

Figure 20: Satisfaction with quality of content for ‘news and information’ by audio source(s)

Base: Those who consume ‘news and information’ (n=2301) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

Half were satisfied with the content from print media (50%), followed by roughly four in ten for online media sources (42%) and social network sites (39%). Compared to the baseline wave, satisfaction has declined for all types of other media content, with more Canadians expressing softer views and dissatisfaction with each.

Figure 21: Satisfaction with quality of content for ‘news and information’ by other media source(s)

Base: Those who consume ‘news and information’ (n=2301) content, base varies by source

Q19. Overall, how satisfied are you with the quality of content you receive for…?

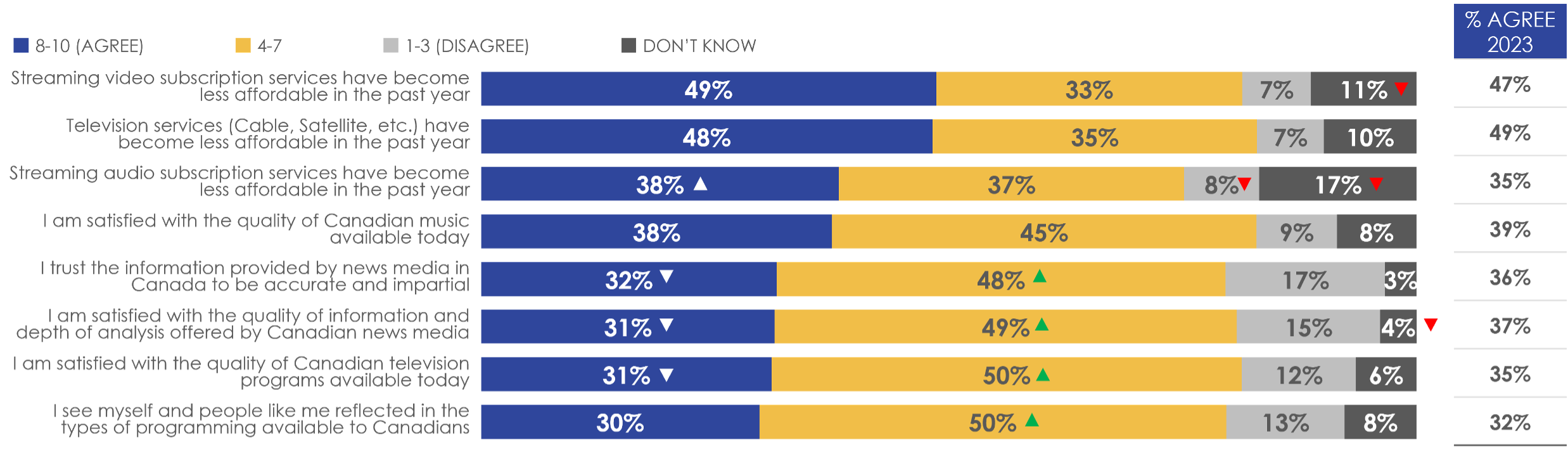

Roughly half of Canadians agreed that streaming video subscription services (49%) and television services (48% have become less affordable in the last year, while four in ten (38%) felt streaming audio subscription services have become less affordable.

Nearly four in ten agreed they are satisfied with the quality of Canadian music available today (38%), while three in ten said they trust the information provided by news media in Canada to be accurate and impartial (32%), are satisfied with the quality of information and analysis offered by Canadian news media (31%), and with the quality of Canadian television programs (31%), and that they see themselves reflected in the programming available (30%).

Compared to the baseline wave, more Canadians agreed that streaming audio subscriptions have become less affordable, while fewer expressed trust in Canadian news media, satisfaction with the quality and depth of news coverage, and with the quality of Canadian television programs.

Canadians aged 45-64 were more likely to agree that television services (Cable, Satellite, etc.) have become less affordable in the past year.

Figure 22: Attitudes towards broadcasting

Base: All answering (base varies)

Q20. Please indicate the extent to which you agree or disagree with each of the following statements.

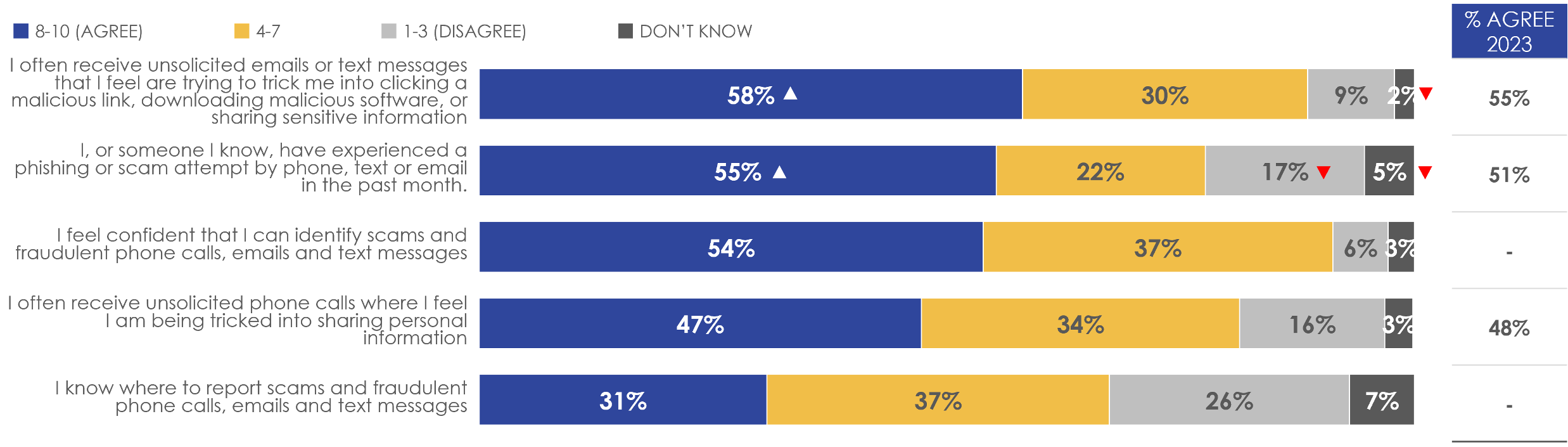

Six in ten Canadians agreed that they often receive unsolicited emails, texts and calls trying to trick them into clicking malicious links or sharing personal information (58%), more than half said that they or someone they know have experienced a scam attempt (55%), while just under half (47%) agreed that they often receive unsolicited calls trying to trick them into sharing personal information. More than half of Canadians agreed that they feel confident identifying fraudulent calls, emails, or text messages (54%), while three in ten (31%) said they know where to report scams.

Compared to the baseline wave, more Canadians agreed that they often receive unsolicited emails, texts and calls trying to trick them into clicking malicious links or sharing personal information, and that they or someone they know have experienced a phishing or scam attempt in the last month.

Figure 23: Attitudes towards spam and nuisance

Base: All answering (base varies)

Q20. Please indicate the extent to which you agree or disagree with each of the following statements.

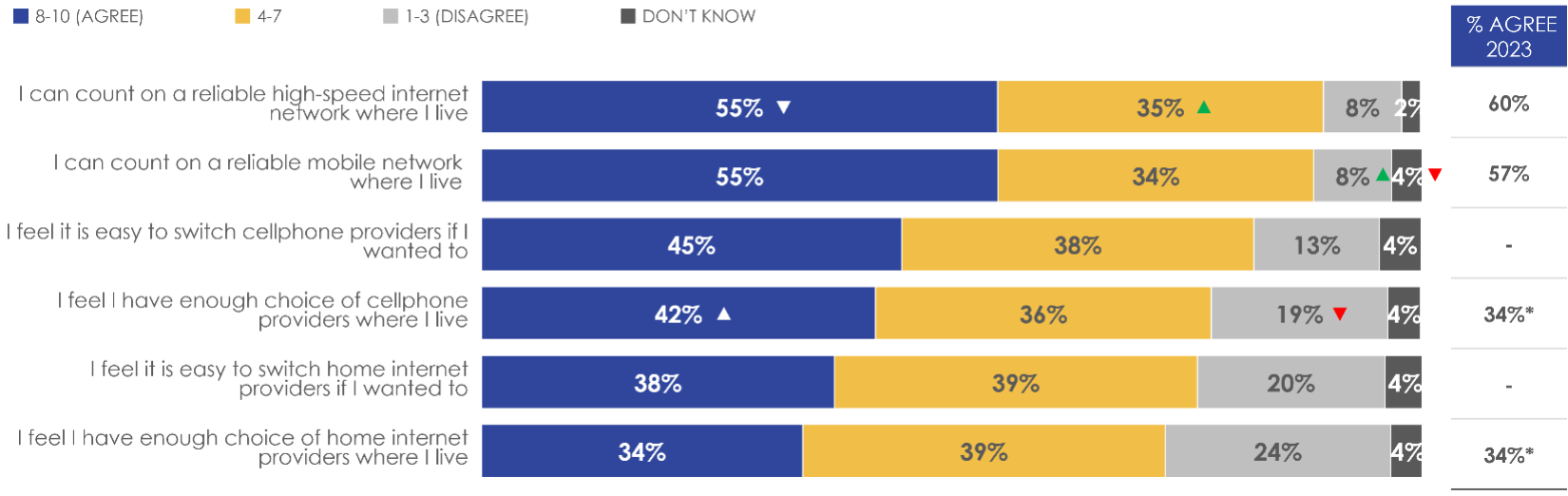

Over half of Canadians agreed that they can count on reliable high-speed internet (55%) and mobile networks (55%) where they live. Over four in ten agreed that it is easy to switch cellphone providers if they wanted to (45%), and that they have enough choice of cellphone providers where they live (42%), while fewer than four in ten felt it is easy to switch internet providers if they wanted to (38%), and one-third (34%) that they feel they have enough choice of cellphone providers.

Compared to the baseline wave, more Canadians agreed that they have enough choice of cellphone providers where they live, while fewer agreed that they can count on reliable high-speed internet where they live, and a higher proportion disagreed that they can count on reliable mobile networks.

Figure 24: Attitudes towards telecommunications (1/2)

Base: All answering (base varies)

Q20. Please indicate the extent to which you agree or disagree with each of the following statements.

*Note: Broader statement was asked in 2023 as follows: ‘I feel I have enough choice of telecommunications providers where I live’

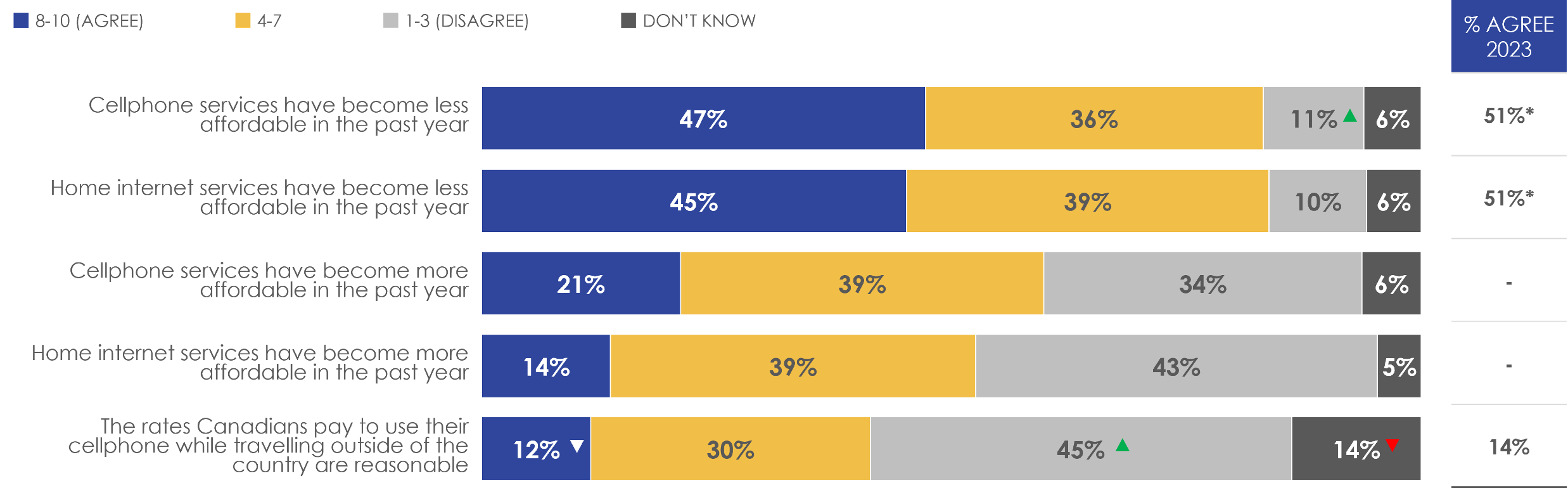

Just under half of Canadians agreed that cellphone (47%) and home internet services (45%) have become less affordable in the last year, while roughly one in ten felt the rates Canadians pay to use their cellphone while travelling internationally are reasonable (12%). Compared to the baseline wave (14%), fewer Canadians agreed that international cellphone usage rates are reasonable.

New this wave, alternative wording was included for both statements about affordability to assess if results differed when asked if each service were ‘more affordable’ in the past year. Results for home internet services largely consistent and the inverse of the previous wording, while there were greater differences in responses between statements about cellphone services. One in five (21%) agreed that cellphone services have become more affordable in the last year, while roughly one in ten felt home internet has become more affordable.

Figure 25: Attitudes towards telecommunications (2/2)

Base: All answering (base varies)

Q20. Please indicate the extent to which you agree or disagree with each of the following statements.

*Note: Broader statement was asked in 2023 as follows: ‘Telecommunications services have become less affordable in the past year’

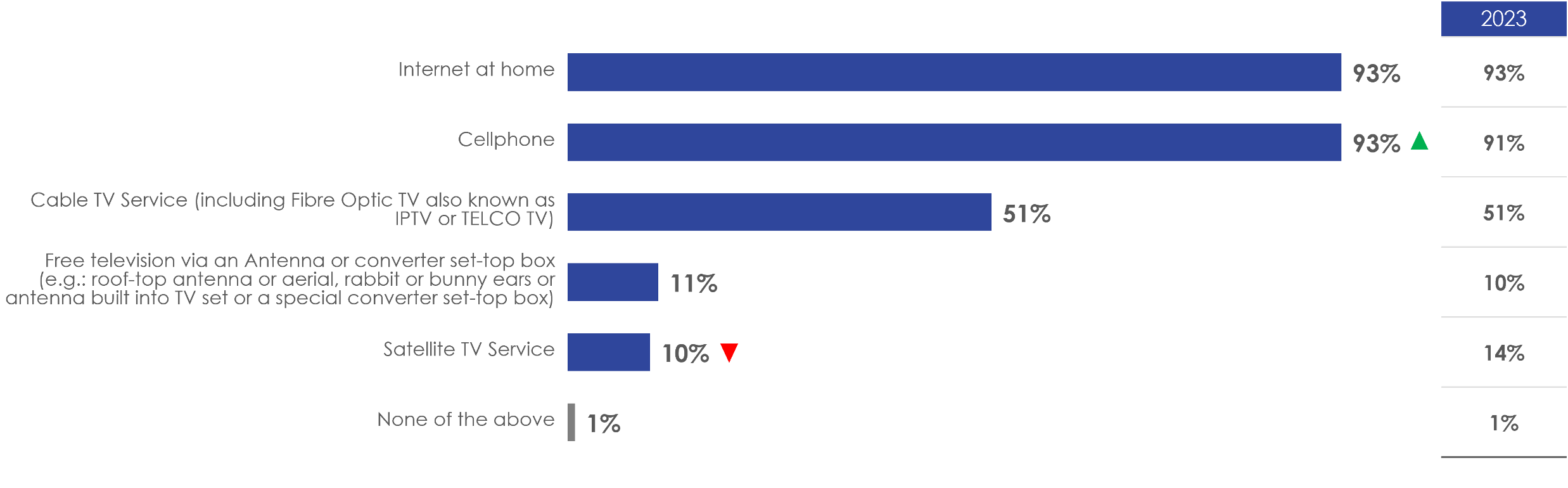

More than nine in ten Canadians reported they currently have internet (93%) or cellphone service (93%), while half said they receive cable TV service (51%). One in ten reported they currently have satellite TV (10%) or free television services (11%). Compared to the baseline wave, more Canadians reported having cellphone services, while fewer said they have satellite TV service.

Figure 26: Service(s) received

Base: All respondents (n=2541)

Q1. Which of the following telecommunications and television services do you currently have for your personal use? Please select all that apply.

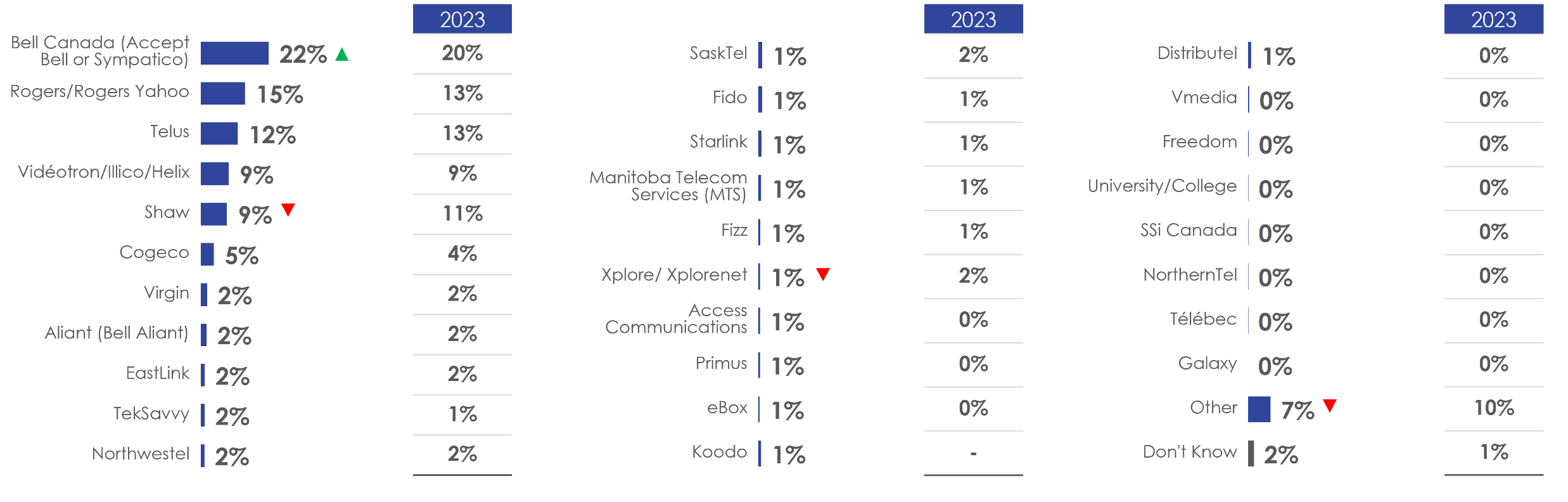

Among those who currently have internet at home, the most common service provider was Bell Canada (22%), followed by Rogers (15%) and Telus (12%), Videotron (9%), and Shaw (9%). Compared to the baseline wave, more reported that their service provider is Bell, while fewer said that their provider is Shaw, Xplore, or another provider.

Figure 27: Internet service provider

Base: Those who have internet services (n=2375)

Q4. Which company provides your home Internet connection?

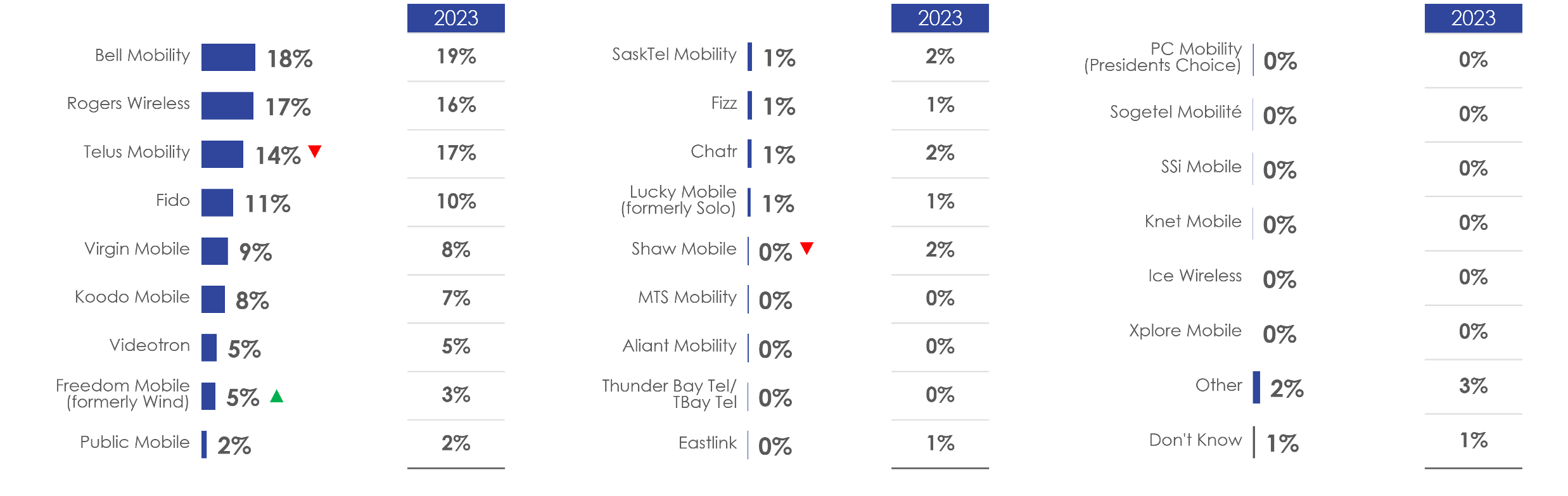

Among those who currently have cellphone service, the most common service provider was Bell Mobility (18%), followed by Roger Wireless (17%) and Telus Mobility (14%). Other more common service providers included Fido (11%), Virgin Mobile (9%), Koodo Mobile (8%) and Videotron (5%). Compared to the baseline wave, fewer reported that their service provider is Telus Mobility or Shaw Mobile, while more said that their provider is Freedom Mobile.

Figure 28: Cellphone service provider

Base: Those who have cellphone services (n=2364)

Q5. Which company provides your cellphone service?

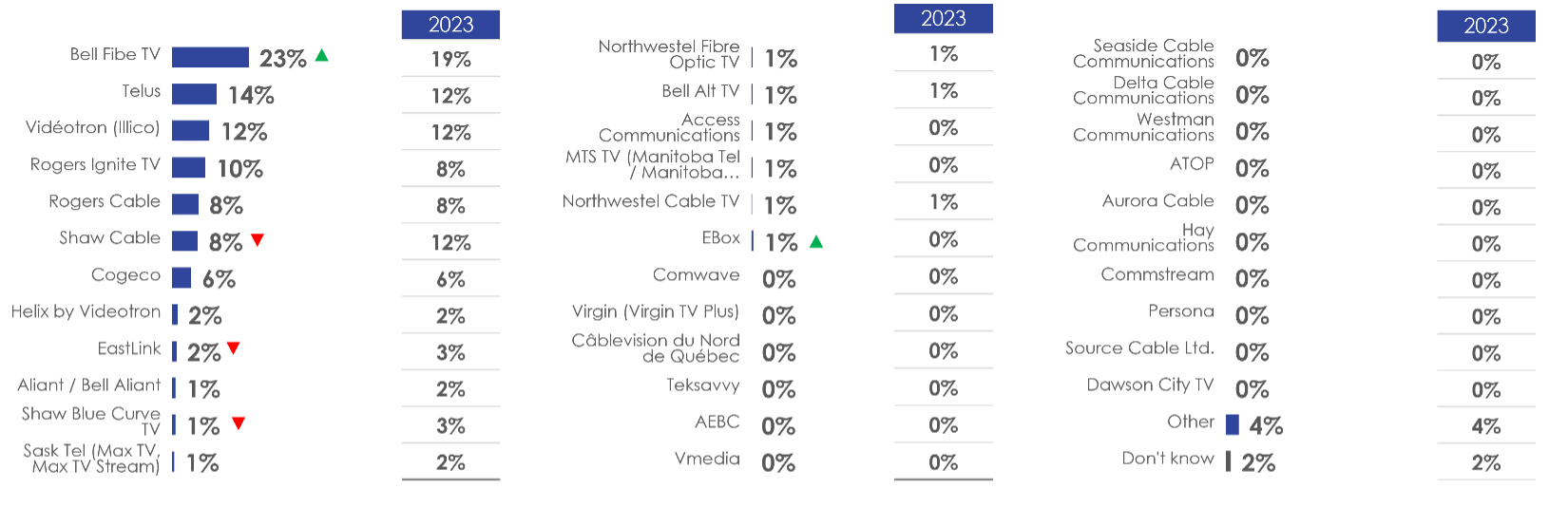

Among those who currently have cable TV service, the most common service provider was Bell Fibe TV (23%), followed by Telus (14%), Vidéotron (12%), and Rogers Ignite TV (10%). Other more common providers included Rogers Cable and Shaw Cable (both 8%). Compared to the baseline wave, more reported that their cable TV service provider is Bell Fibre TV and EBox, while fewer said that their provider is Shaw Cable, EastLink, or Shaw Blue Curve TV.

Figure 29: Cable TV service provider

Base: Those who have cable TV service (n=1312)

Q2. Which company provides your Cable TV Service?

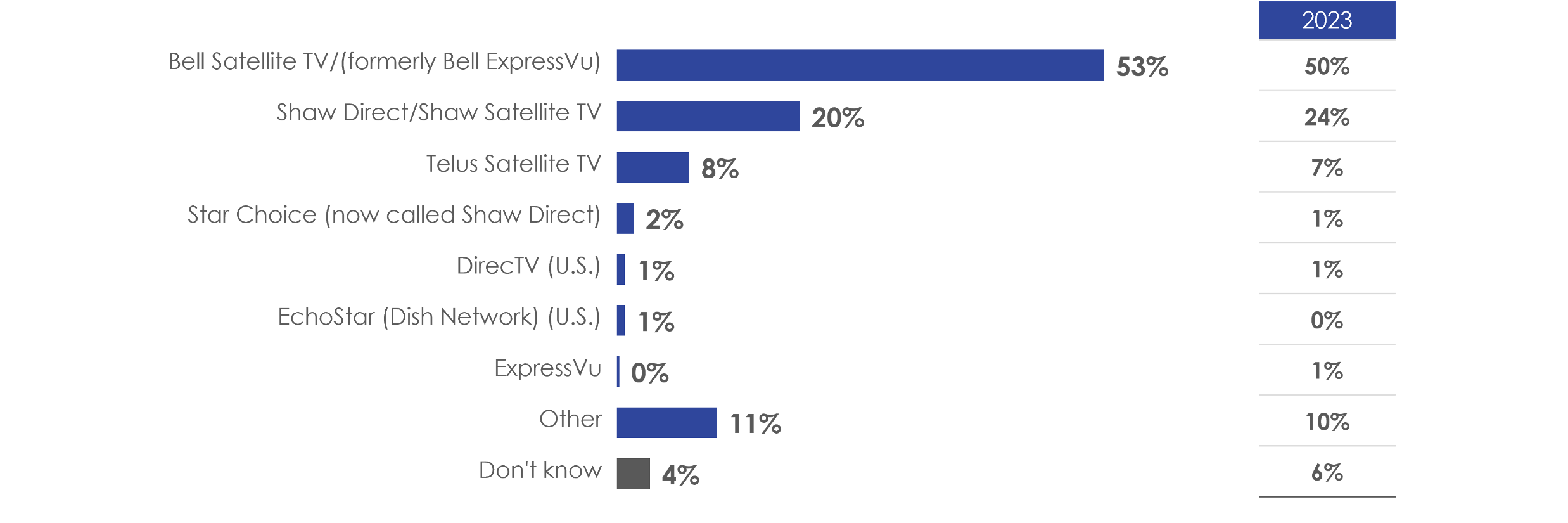

Among those who currently have satellite TV service, the most common service provider was Bell Satellite TV (53%), followed by Shaw Direct/Shaw Satellite TV (20%), Telus (8%), or another provider (11%). There were no statistically significant shifts compared to the baseline wave.

Figure 30: Satellite TV service provider

Base: Those who have satellite TV service (n=245)

Q3. Which company provides your Satellite TV Service?

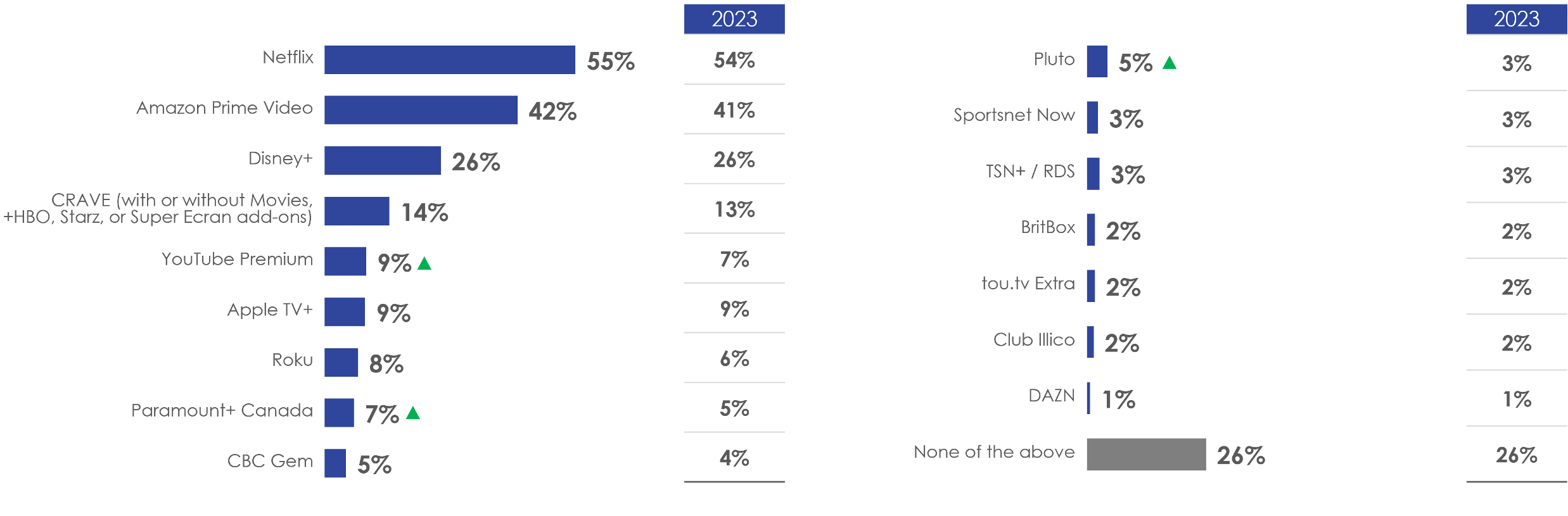

Nearly three-quarters (74%) of Canadians reported they currently subscribe (or have access to) at least one type of video streaming service. The most common service received was Netflix (55%), followed by Amazon Prime Video (42%), and Disney+ (26%). Other more common services included CRAVE (14%), YouTube Premium (9%), Apple TV+ (9%), Roku (8%) and Paramount+ Canada (7%). Compared to the baseline wave, more reported being subscribed to YouTube Premium, Paramount+ Canada, or Pluto.

Figure 31: Video steaming services provider(s)

Base: All respondents (n=2541)

Q6. Do you currently subscribe (or have access) to any of the following video streaming services?

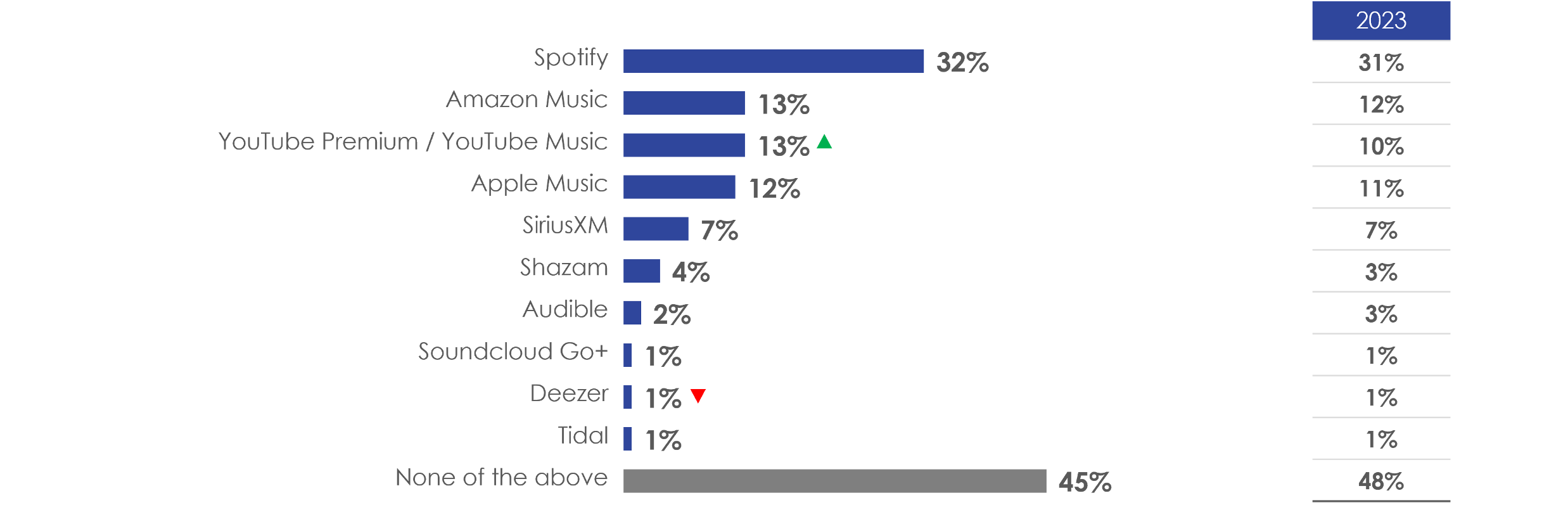

Over half (55%) of Canadians reported they currently subscribe (or have access to) at least one type of audio streaming service1. The most common service received was Spotify (32%), followed by Amazon Music and YouTube Music (13% each), Apple Music (12%), and Sirius XM (7%). Compared to the baseline wave, more said they are subscribed to YouTube Music, while fewer said they are subscribed to Deezer.

1 Note: responses to this question are based on respondent perceptions of services to which they subscribe.

Figure 32: Audio steaming services provider(s)

Base: All respondents (n=2541)

Q7. Do you currently subscribe (or have access) to any of the following audio streaming services?

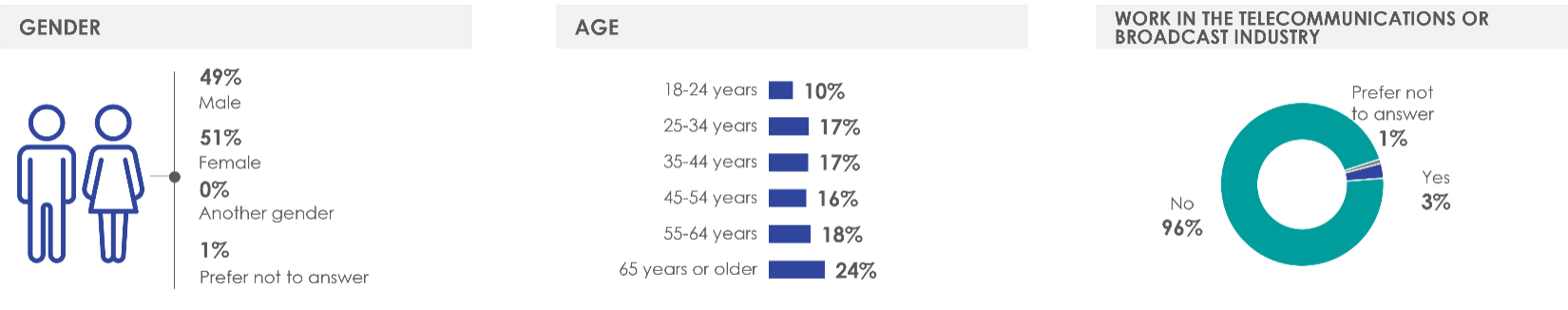

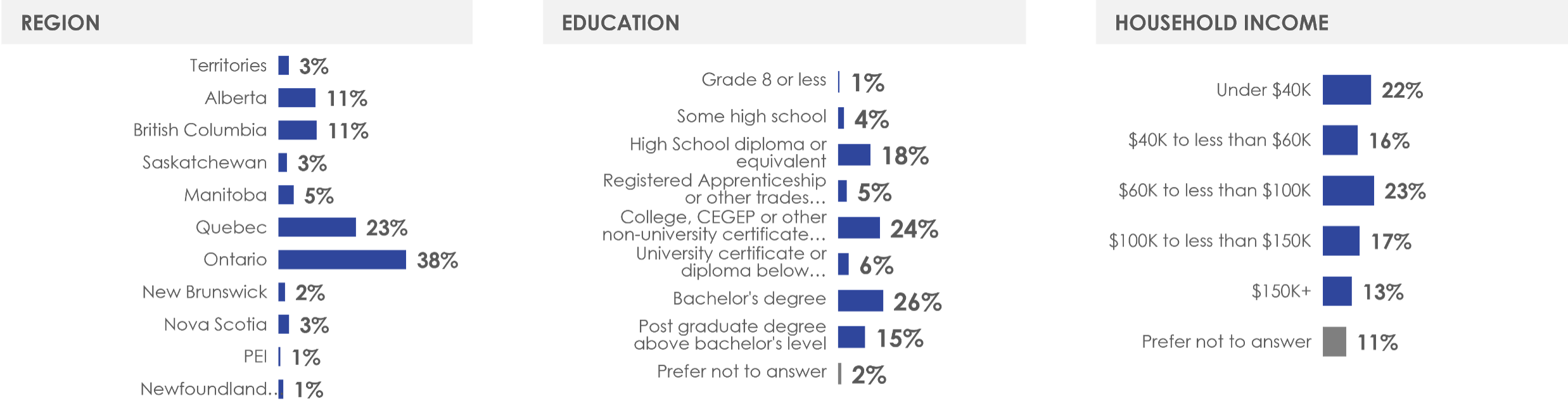

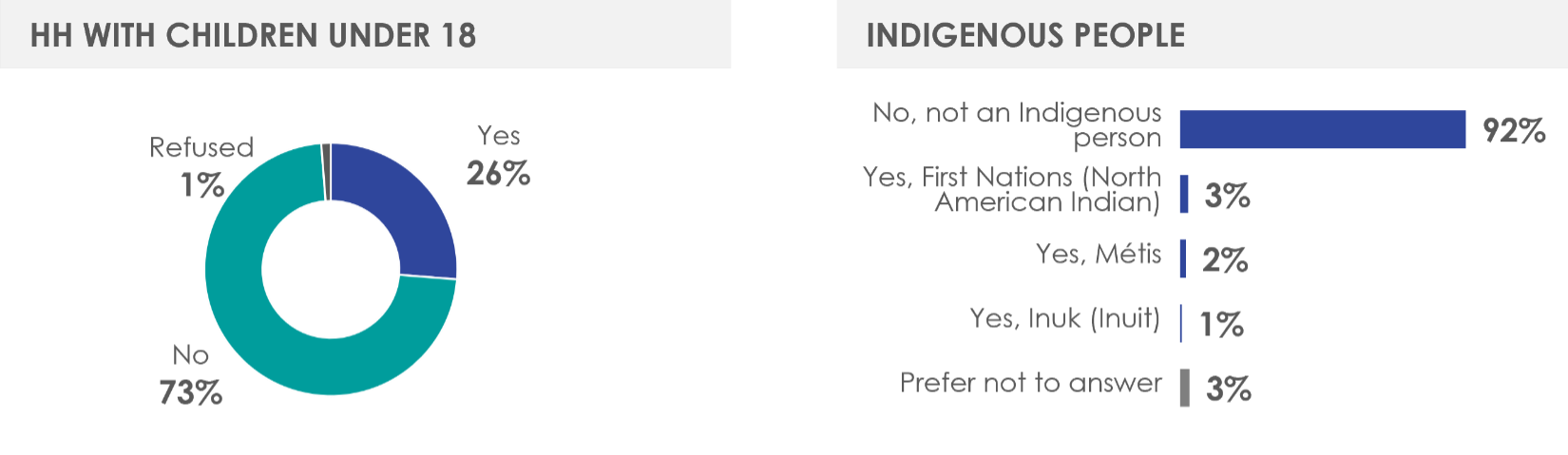

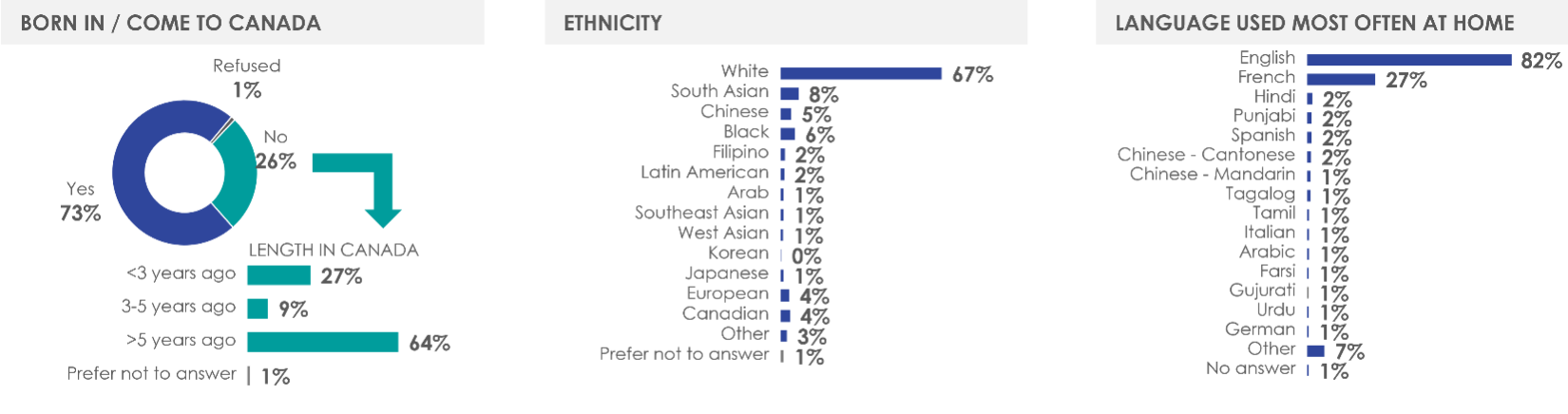

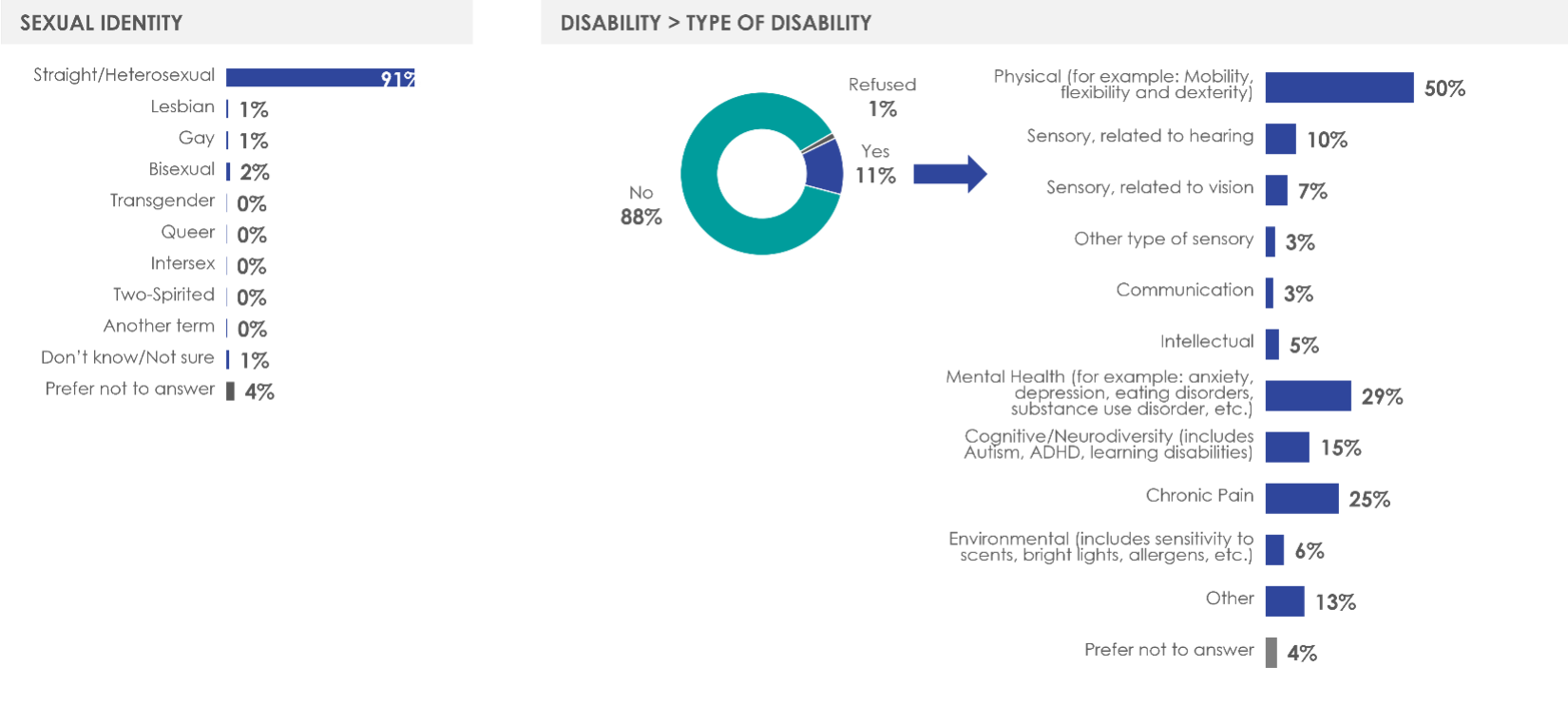

The demographic characteristics of the surveyed populations are presented below. Data presented are weighted proportions.

Figure 33: Profile of respondents (1/5)

Figure 34: Profile of respondents (2/5)

Figure 35: Profile of respondents (3/5)

Figure 36: Profile of respondents (4/5)

Figure 37: Profile of respondents (5/5)

Ipsos conducted a quantitative survey through a mixed methodology approach including online and telephone interviews among a national sample of 2,541 Canadians aged 18 years and older (1,563 online, 978 telephone) stratified to the actual proportion of the Canadian population based on the 2021 Census by age, gender, and region. Results were accurate to within + 3.0 percentage points of what the results would have been had every Canadian been polled. Fieldwork was conducted from February 14 to March 29, 2024. Average survey length was 19 minutes (21 minutes online, 16 minutes by telephone) and the survey was offered in English and French.

Minimum sample sizes (of at least 100) were achieved among key audiences including Anglophones (n=1800), Francophones (n=513), Indigenous peoples (n=138), OLMCs (n=144), racialized Canadians (n=759), and 2SLGBTQI+ (n=212). Oversamples of TSLGBTQ+ Canadians and those residing in the North were required and notably, fieldwork in the North proved more challenging than anticipated and the target of n=100 could not be achieved in the fieldwork period (n=83 was achieved).

The online survey was administered using Computer Assisted Web Interviewing (CAWI) and the sample was sourced from the online panel from Ipsos’ partner Canadian Viewpoint Inc. The survey platform will be Accessibility for Ontarians with Disabilities Act (AODA) compliant according to Web Content Accessibility Guidelines (WCAG2.0AA). Incentives are not used for recruitment purposes to ensure quality, but respondents are incentivized for completing survey directly proportionate to the amount of time taken to complete the survey and with comparable incentives offered by other online panel sources.

The telephone survey was administered through Computer Assisted Telephone Interviewing (CATI) and included a sampling of Canadians by landline and cell phone. Respondents will be selected at random utilizing a random digit dialing (RDD) approach. In order to help ensure the inclusion of people with disabilities TTY will be offered so that those respondents with hearing or speech impairment can readily participate.

The survey was registered with the Canadian Research Insights Council (CRIC) and a survey registration number made available so that survey respondents had the ability to verify the legitimacy of the survey as a research initiative sponsored by the Government of Canada.

The table below indicates the unweighted (counts and proportions) and weighted demographic distribution (proportions) of the sample. Weighting was applied to the responses to ensure that the final data reflects the adult population of Canada, as per Statistics Canada Census 2021, by age, gender, and region.

Figure 38: Sample frame

| Age | Unweighted Sample Size | Unweighted Sample Proportions | Weighted Sample Proportions (Based on 2021 Census) |

|---|---|---|---|

| 18-24 | 202 | 8% | 10% |

| 25-34 | 383 | 15% | 17% |

| 35-44 | 414 | 16% | 17% |

| 45-54 | 425 | 17% | 16% |

| 55-64 | 452 | 18% | 18% |

| 65+ | 665 | 26% | 24% |

| Gender | |||

| Men | 1309 | 52% | 49% |

| Women | 1200 | 47% | 51% |

| Other/ Prefer not to answer | 32 | 1% | <1% |

| Region | |||

| BC | 347 | 14% | 14% |

| AB | 265 | 10% | 11% |

| MB/SK | 163 | 6% | 7% |

| ON | 949 | 37% | 38% |

| QC | 571 | 23% | 23% |

| ATLANTIC | 183 | 6% | 7% |

| NORTH | 83 | 3% | <1% |

If there is no systematic bias in responding to the survey, the unweighted profile of the survey participants would be very similar to the profile of the Canadian population according to the Statistics Canada Census 2021 (within the sampling error). The tables above demonstrate that, in most cases, the survey sample was very similar to the representative distribution of the Canadian population with respect to age, gender, and region. With respect to region, since disproportionate sampling was employed to provide larger sample sizes among those who reside in the North it was expected that the unweighted proportions for those regions would be higher than the actual proportion of the Canadian population. Aside from this, the unweighted profile of survey participants and the profile of the Canadian population are consistent, indicating that non-response bias was likely not an important factor in this research.

For the online survey, since a non-probability sample was used a response rate cannot be calculated. The following table provides the participation rate for this online survey. The participation rate for this survey was 3%, and it is calculated as follows:

Figure 39: Participation rate calculation

| Disposition | Survey |

|---|---|

| Invalid Cases | 683 |

| Unresolved (U) | 0 |

| In-scope non-responding (IS) | 57,970 |

| Responding units (R) | 3,765 |

| Participation Rate = R / (R + IS + U) | 6% |

Online survey cases can be broken down into four broad categories:

These can include only clearly invalid cases (for example, invitations mistakenly sent to people who did not qualify for the study, or incomplete or missing email addresses in a client-supplied list).

These include all the cases where it cannot be established whether the invitation was sent to an eligible or an ineligible respondent or unit (for example, when email invitations bounce back or remain without an answer before the candidate could be qualified).

These include all refusals, either implicit or explicit, all non-contacts and early break-offs of known eligible cases, and other eligible non-respondents (due to illness, leave of absence, vacation or other).

These include cases who have participated but who were disqualified afterwards (for example, when admissible quotas have been reached). It also includes all completed surveys or partially completed surveys that meet the criteria set by the researcher to be included in the analysis of the data.

Unresolved (U), in-scope (IS), and responding units (R) are all included in the broad category of ‘potentially eligible’ cases. However, invalid cases are not included in the calculation of outcome rates.

For this survey, a router was used to screen potential respondents and assign them to one of the surveys from the router. The router is a platform used to distribute and manage surveys. This means that individuals who were not eligible to participate in this study because they did not meet the screening criteria would be sent to participate in other surveys that might have been available in the router at that point.

The router assignment precedes the actual survey, and given this, it is not possible to estimate the number of cases ‘invited’ to participate and whether they were eligible or not. Therefore, it is not possible to estimate the ‘unresolved’ cases. For this survey, responding units are broken out as follows.

Figure 40: Completions

| Disposition | Survey |

|---|---|

| Over quota | 2,187 |

| Qualified Completes | 1,563 |

| Partials | 15 |

| Responding units (R) | 3,765 |

For the telephone survey, the following table provides the response dispositions and response rate calculation. A minimum of five calls were placed in an effort to reach a selected respondent. The overall response rate achieved was 4% and was calculated as follows:

Figure 41: Call Disposition

| Call Outcome | Count of Disposition |

|---|---|

| Call backs | 799 |

| Completed Interviews | 1000 |

| Disqualified | 575 |

| Language Barriers | 384 |

| No Answers | 28,594 |

| Not In Service (Out of Scope) | 64,137 |

| Over quota | 28 |

| Refusals | 12,148 |

| Terminations | 103 |

| TOTAL IN SCOPE | 43,631 |

| TOTAL RESPONDING | 1,575 |

| OVERALL RESPONSE RATE | 4% |

Online Questionnaire

Introduction

Thank you for your interest in taking this survey. The Canadian Radio-television and Telecommunications Commission (CRTC) has commissioned Ipsos, a market research firm, to conduct a public opinion survey. The CRTC is interested in learning your views on a variety of topics related to the telecommunications and broadcast services you use, the impressions of the service you receive and your general attitudes towards the communications sectors in Canada (i.e. cellphone, home phone, TV, radio, online services, etc.).

Your participation is voluntary and completely confidential. Your answers will remain anonymous. The information you provide will be used for research purposes only and will be administered according to the requirements of the Privacy Act, the Access to Information Act, and any other pertinent legislation.

The survey will take about 15 minutes to complete depending on your responses.

Should you wish to verify the credibility of this survey, you can utilize the Canadian Research Insights Council (CRIC)

Research Verification Service by clicking here and entering the following project code: 20240220-IP036

If you have any questions about how to complete the survey or encountered any technical issues, please email Meghan.Miller@ipsos.com.

Thank you in advance for your participation.

Screeners

S1. What is your date of birth?

[DROPDOWN YEAR] 1910 – 2015

[DROPDOWN MONTH] January - December

[IF LESS THAN 18 YEARS OLD, THANK YOU AND TERMINATE]

HIDDEN VARIABLE- AGE QUOTAS

18-24 years

25-34 years

35-44 years

45-54 years

55-64 years

65 years or older

S2. What is your gender?

Male

Female

Non-binary person

Or, please specify:

Prefer not to say

S3. What is your postal code?

Please note: This question may be considered personal. We would like to remind you that your participation is strictly voluntary and that your responses are used for research purposes only. The answers that you provide will be presented in aggregate form and none of them will be linked back to you in any way. All data will be collected and processed in accordance with applicable data protection legislation.

Please enter your 6 digit postal code with no spaces.

Please specify:

Don't know / Prefer not to say

[IF S3 = Don't know/ Prefer not to say ASK S4, OTHERWISE SKIP]

QS4. In which province or territory do you live?

Alberta

British Columbia

Manitoba

New Brunswick

Newfoundland and Labrador

Nova Scotia

Northwest Territories

Nunavut

Ontario

Prince Edward Island

Quebec

Saskatchewan

Yukon

31. Do you consider yourself to be:

Straight/Heterosexual

Lesbian

Gay

Bisexual

Transgender

Queer

Intersex

Two-Spirited

Another term

Don’t know/Not sure [MUTUALLY EXCLUSIVE][ANCHOR]

Prefer not to answer [MUTUALLY EXCLUSIVE][ANCHOR]

Provider Classification

1. Which of the following telecommunications and television services do you currently have for your personal use? Please select all that apply.

Cellphone

Internet at home

Cable TV Service (including Fibre Optic TV also known as IPTV or TELCO TV)

Satellite TV Service

Free television via an Antenna or converter set-top box (e.g.: Roof-top antenna or aerial, rabbit or bunny ears or antenna built into TV set or a special converter set-top box)

None of the above [MUTUALLY EXCLUSIVE]

[IF SELECTED 'Cable TV Service' AT Q1 ASK Q2, OTHERWISE SKIP]

2. Which company provides your Cable TV Service?

Access Communications

AEBC

Aliant/ Bell Aliant

ATOP

Aurora Cable

Bell Fibe TV

Bell Alt TV

Hay Communications

Câblevision du Nord de Québec

Commstream

Comwave

Cogeco

Delta Cable Communications

EastLink

EBox

Helix by Videotron

MTS TV (Manitoba Tel/Manitoba Telecom Service)

Northwestel Fibre Optic TV

Persona

Rogers Cable

Rogers Ignite TV

Sask Tel (Max TV, Max TV Stream)

Seaside Cable Communications

Shaw Cable

Shaw Blue Curve TV

Source Cable Ltd.

Teksavvy

Telus

Vidéotron (Illico)

Westman Communications

Vmedia

Virgin (Virgin TV Plus)

Dawson City TV

Northwestel Cable TV

Other

Don't know

[IF SELECTED 'Satellite TV Service' AT Q1 ASK Q3, OTHERWISE SKIP]

3. Which company provides your Satellite TV Service?

Bell Satellite TV/ (formerly Bell ExpressVu)

DirecTV (U.S.)

EchoStar (Dish Network) (U.S.)

ExpressVu

Shaw Direct / Shaw Satellite TV

Star Choice (now called Shaw Direct)

Telus Satellite TV

Other

Don't know

[IF SELECTED 'Internet at home' AT Q1 ASK Q4, OTHERWISE SKIP]

4. Which company provides your home Internet connection?

Access Communications

Aliant (Bell Aliant)

Bell Canada (Accept Bell or Sympatico)

Cogeco

Distributel

EastLink

Manitoba Telecom Services (MTS)

NorthernTel

Primus

Rogers /Rogers Yahoo

SaskTel

Shaw

Starlink

TekSavvy

Telus

University/College

Vidéotron/Illico/Helix

Explorenet (Xplorenet)

Télébec

Fido

Virgin

eBox

Fizz

Freedom

Northwestel

Galaxy

SSi Canada

Vmedia

Other

Don't Know

[IF SELECTED 'Cellphone' AT Q1 ASK Q5, OTHERWISE SKIP]

5. Which company provides your cellphone service?

Aliant Mobility

Bell Mobility

Fido

Koodo Mobile

MTS Mobility

PC Mobility (Presidents Choice)

Public Mobile

Rogers Wireless

SaskTel Mobility

Telus Mobility

Videotron

Virgin Mobile

Freedom Mobile (formerly Wind)

Eastlink

Chatr

Lucky Mobile (formerly Solo)

Thunder Bay Tel/TBay Tel

Fizz

Shaw Mobile

Ice Wireless

Knet Mobile

Sogetel Mobilité

SSi Mobile

TbayTel Mobilit

Xplore Mobile

Other

Don't Know

6. Do you currently subscribe (or have access) to any of the following video streaming services?

[RANDOMIZE]

Netflix

Amazon Prime Video

CRAVE (with or without Movies, +HBO, Starz, or Super Ecran add-ons)

Apple TV+

Disney+

YouTube Premium

Club Illico

Pluto

Roku

Paramount+ Canada

tou.tv Extra

BritBox

CBC Gem

Sportsnet Now

DAZN

TSN+/ RDS

None of the above [MUTUALLY EXCLUSIVE]

7. Do you currently subscribe (or have access) to any of the following audio streaming services?

[RANDOMIZE]

Spotify

Apple Music

YouTube Premium/YouTube Music

Soundcloud Go+

Amazon Music

SiriusXM

Tidal

Deezer

Audible

Shazam

None of the above [MUTUALLY EXCLUSIVE]

Sentiment towards Provider(s)

[ASK Q10 IF Q1 EQUAL ANY OF CELLPHONE, HOME INTERNET, CABLE TV, SATELLITE TV, OTHERWISE SKIP TO Q12 THEN SKIP TO Q18]

10. Thinking about the last month, have you or anyone in your household made changes to any of your cellphone, television and/ or streaming services to make them more affordable? This may include altering the services you receive, that you planned on cancelling but were convinced to stay with a better price, cancelling and switching to a different provider or cancelling the service entirely.

[ROWS]

Made changes to make services more affordable

Planned on cancelling but was convinced to stay with a better price

Cancelled and switched to a different provider

Cancelled service entirely

[COLUMNS]

Yes

No

[IF SELECTED YES TO EITHER ‘Made changes‘, ‘Planned on cancelling’ OR ‘Cancelled and switched to a different provider’ AT Q10 ASK Q11, OTHERWISE SKIP]

11. Which of these services did you, or someone in your household, [IF SELECTED ‘Made changes’ at Q10 INSERT ‘make changes to’],[IF SELECTED ‘Planned on cancelling’ at Q10 INSERT ‘plan on cancelling but were convinced to stay with a better price instead’],[IF SELECTED ‘Cancelled’ INSERT ‘cancel and switch to a different provider’] in the last month?

[ROWS]

[INSERT SERVICE(S) INDICATED AT Q1 AND Q6, Q7]

Cellphone service

Home internet connection

Cable TV Service

Satellite TV Service

Video streaming services

Audio steaming services

[COLUMNS]

Made changes to make services more affordable

Planned on cancelling but was convinced to stay with a better price

Cancelled and switched to a different provider

12. And, which of these services did you, or someone in your household, cancel entirely?

Cellphone service

Home internet connection

Cable TV Service

Satellite TV Service

[IF NONE OF THE ABOVE IS SELECTED AT Q6 INSERT ‘Video streaming services’]

[IF NONE OF THE ABOVE IS SELECTED AT Q7 INSERT ‘Audio steaming services’]

[IF SELECTED ‘No’ for any services asked at Q10 ASK Q13NEWOTHERWISE SKIP]

13 NEW. You indicated that your household has not made changes to one or more of the telecommunications, television, audio and/or video subscription services you receive in the last month. Why would you say you have not made changes to these services?

[INSERT TEXT BOX]

No comment

14. How confident or not are you that you and your household will be able to pay for your telecommunications, television, audio and/or video subscription services without making any changes in the next three months?

[INSERT SERVICE(S) INDICATED AT Q1 AND Q6, Q7]

Cellphone service [SHOW IF SELECTED AT Q1]

Home internet connection [SHOW IF SELECTED AT Q1]

Cable TV Service [SHOW IF SELECTED AT Q1]

Satellite TV Service [SHOW IF SELECTED AT Q1]

Video streaming services [SHOW IF NONE IS NOT SELECTED AT Q6]

Audio steaming services [SHOW IF NONE IS NOT SELECTED AT Q7]

SCALE 1- 10: 1 ‘Not at all confident’, 10 ‘Very confident’

Prefer not to say

Don’t know

14A. Have you experienced any major service disruptions lasting 24 hours or longer for any of the telecommunications, television, audio and/or video subscription services you receive? Please select all that apply.

[INSERT SERVICE(S) INDICATED AT Q1 AND Q6, Q7]

Cellphone service [SHOW IF SELECTED AT Q1]

Home internet connection [SHOW IF SELECTED AT Q1]

Cable TV Service [SHOW IF SELECTED AT Q1]

Satellite TV Service [SHOW IF SELECTED AT Q1]

Video streaming services [SHOW IF NONE IS NOT SELECTED AT Q6]

Audio steaming services [SHOW IF NONE IS NOT SELECTED AT Q7]

None of the above

Perceptions of the CRTC

14B. Overall, how informed are you about the mandate and role of the Canadian Radio-television and Telecommunications Commission (CRTC)?

Very well informed

Well informed

Not very well informed

Not informed

14C. The Canadian Radio-television and Telecommunications Commission (CRTC) is an administrative tribunal that regulates and supervises broadcasting and telecommunications in the public interest. It is dedicated to ensuring that Canadians have access to a world-class communication system that promotes innovation and enriches their lives.

How closely does this statement align with your understanding of the mandate and role of the CRTC before taking this survey?

Completely

Somewhat

A little

Not at all

14D. What is your impression of the CRTC?

Very favourable

Somewhat favourable

Neutral

Somewhat unfavourable

Very unfavourable

Don’t know enough to provide an opinion

[IF VERY FAVOURABLE, SOMEWHAT FAVOURABLE, NEUTRAL, SOMEWHAT UNFAVOURABLE OR VERY UNFAVOURABLE ASK Q14E, OTHERWISE SKIP]

14E. You indicated you have a [INSERT RESPONSE FROM Q14D] impression of the CRTC. Why do you say that?

[INSERT TEXT BOX]

14F. To what extent do you agree or disagree with the following statements:

[RANODMIZE]

I trust the CRTC to regulate and supervise the broadcasting and telecommunications in the public interest

I believe the CRTC’s work is beneficial to Canadians

I am interested in hearing, reading or seeing more from the CRTC

I have the information I need to make informed decisions on whether to participate in public consultations

I know how to participate in public consultation

[COLUMNS][SCALE]

1- 10: 1 ‘Strongly disagree’, 10 ‘Strongly agree’, Don’t know

14G. Do you recall seeing or hearing anything about the CRTC over the past year?

Yes

No

Primary source(s) and satisfaction with programming

18. What are your primary source(s) of media content for ‘news and information’ and ‘entertainment’? Please select the most common source(s) you use for each.

[ROWS]

News and information

Entertainmen

[COLUMNS]

Video [HEADER]

Regular Television (cable, satellite, etc. including online)

Online video streaming services (e.g. Netflix, Amazon Prime, Disney+, Crave) Online social media (e.g. YouTube)

Audio [HEADER]

AM/FM Radio from any source (including online streams and HD radio broadcasts)

Online music streaming services (e.g. Spotify, Apple Music)

Online social media (e.g. YouTube)

Audio podcasts (e.g. Audible)

Audio books, newspapers or magazines

Other Media [HEADER]

Print media sources (hard copy newspaper, magazines, etc.)

Online media sources

Social networking sites

Another source(s)

I don’t consume this type of content [MUTUALLY EXCLUSIVE]

Don’t know [MUTUALLY EXCLUSIVE]

[IF SELECTED ‘I don’t consume this type of programming’ OR ‘Don’t know’ FOR ALL ITEMS AT Q18 SKIP, OTHERWISE CONTINUE]

19. Overall, how satisfied are you with the quality of content you receive for…?

[ROWS][RANDOMIZE]

[INSERT ITEMS FROM Q18 WHERE RESPONSE IS NOT ‘I don’t consume this type of programming’ OR ‘Don’t know’]

News and information

Entertainment

[COLUMNS]

SCALE 1- 10: 1 ‘Very dissatisfied’, 10 ‘Very satisfied’

Broader Attitudes

20. Please indicate the extent to which you agree or disagree with each of the following statements.

[ROWS][RANDOMIZE]

BROADCASTING [HEADER, DO NOT PROGRAM]

I trust the information provided by news media in Canada to be accurate and impartial

I am satisfied with the quality of information and depth of analysis offered by Canadian news media

I am satisfied with the quality of Canadian music available today

I am satisfied with the quality of Canadian television programs available today

I see myself and people like me reflected in the types of programming available to Canadians

Television services (Cable, Satellite, etc.) have become less affordable in the past year

Streaming video subscription services have become less affordable in the past year

Streaming audio subscription services have become less affordable in the past year

SPAM AND NUISANCE [HEADER, DO NOT PROGRAM]

I, or someone I know, have experienced a phishing or scam attempt by phone, text or email in the past month.

I often receive unsolicited phone calls where I feel I am being tricked into sharing personal information

I often receive unsolicited emails or text messages that I feel are trying to trick me into clicking a malicious link, downloading malicious software, or sharing sensitive information

I feel confident that I can identify scams and fraudulent phone calls, emails and text messages

I know where to report scams and fraudulent phone calls, emails and text messages

BROADBAND AND MOBILE [HEADER, DO NOT PROGRAM]

Cellphone services have become [SPLIT SAMPLE. HALF ASKED ‘more’, HALF ASKED ‘less’] affordable in the past year

Home internet services have become [SPLIT SAMPLE HALF ASKED ‘more’, HALF ASKED ‘less’] affordable in the past year

I can count on a reliable high-speed internet network where I live

I can count on a reliable mobile network where I live I feel I have enough choice of cellphone providers where I live

I feel I have enough choice of home internet providers where I live

[IF SELECTED ‘Internet at home’ AT Q1 ASK] I feel it is easy to switch home internet providers if I wanted to

[IF SELECTED ‘Cellphone’ AT Q1 ASK] I feel it is easy to switch cellphone providers if I wanted to

The rates Canadians pay to use their cellphone while travelling outside of the country are reasonable

[COLUMNS][SCALE]

1- 10: 1 ‘Strongly disagree’, 10 ‘Strongly agree’, Don’t know

Classification questions

We have a couple final questions for statistical classification purposes. Please indicate the answer that best describes you. Be assured that your responses will be held in strict confidence.

22. Do you work in the telecommunications or broadcast industry?

Yes

No

Prefer not to answer

23. Please indicate your annual household income before taxes.

Less than $5,000

$5,000-$9,999

$10,000-$14,999

$15,000-$19,999

$20,000-$24,999

$25,000-$29,999

$30,000-$34,999

$35,000-$39,999

$40,000-$44,999

$45,000-$49,999

$50,000-$54,999

$55,000-$59,999

$60,000-$64,999

$65,000-$69,999

$70,000-$74,999

$75,000-$79,999

$80,000-$84,999

$85,000-$89,999

$90,000-$94,999

$95,000-$99,999

$100,000-$124,999

$125,000-$149,999

$150,000-$199,999

$200,000-$249,999

$250,000 or more

Prefer not to answer

24. What is the highest degree or level of school you have completed?

Grade 8 or less

Some high school

High School diploma or equivalent

Registered Apprenticeship or other trades certificate or diploma

College, CEGEP or other non-university certificate or diploma

University certificate or diploma below bachelor's level

Bachelor's degree

Post graduate degree above bachelor's level

Prefer not to answer

25. Are there any children under 18 years old living or staying at your current address?

Yes

No

Prefer Not to Answer

26. Were you born in Canada?

Yes

No

Prefer not to answer

[IF NO AT Q26 ASK Q27, OTHERWISE SKIP]

27. How long have you lived in Canada?

Less than three years

Three to five years

More than five years

Prefer not to answer

28. Are you an Indigenous person, that is, First Nations (North American Indian), Métis or Inuk (Inuit)? If "Yes", choose the option(s) that best describe(s) you. First Nations (North American Indian) includes both Status and Non-Status Indians.

No, not an Indigenous person [EXCLUSIVE]

Yes, First Nations (North American Indian)

Yes, Métis

Yes, Inuk (Inuit)

Prefer not to answer [EXCLUSIVE]

[IF NO AT Q28 ASK Q29, OTHERWISE SKIP]

29. Are you? Mark more than one option or specify, if applicable.

White

South Asian (e.g., East Indian, Pakistani, Sri Lankan, etc.)

Chinese

Black

Filipino

Latin American

Arab

Southeast Asian (e.g., Vietnamese, Cambodian, Laotian, Thai, etc.)

West Asian (e.g., Iranian, Afghan, etc.)

Korean

Japanese

Other — specify

Prefer not to answer

30. What is the language you use most often at home? If you use more than one language at home, please rank the two most used languages.[RANKING QUESTION, MUST RANK AT LEAST ‘FIRST’]

French

English

American Sign Language (ASL)

Arabic

Bengali

Chinese - Cantonese

Chinese - Mandarin

Chinese - other

Cree

Farsi

German

Greek

Gujurati

Hindi

Inuktitut

Italian

Japanese

Korean

Ojibwe

Portuguese

Punjabi

Quebec Sign Language (LSQ)

Russian

Spanish

Tagalog

Tamil

Urdu

Vietnamese

Other

Prefer not to answer

32. Do you identify as a person with a disability?

Yes

No

Prefer not to answer

[IF YES AT Q32 ASK Q33, OTHERWISE SKIP]

33. What type of disability do you have?

Physical (for example: Mobility, flexibility and dexterity)

Sensory, related to hearing

Sensory, related to vision

Other type of sensory

Communication

Intellectual

Mental Health (for example: anxiety, depression, eating disorders, substance use disorder, etc.)

Cognitive/Neurodiversity (includes Autism, ADHD, learning disabilities)

Chronic Pain

Environmental (includes sensitivity to scents, bright lights, allergens, etc.)

Other

Prefer not to answer

Telephone Questionnaire

Introduction

Hello, my name is (FULL NAME), AND I’m calling from Ipsos, an independent research company. We’re conducting a survey for the CRTC (IF NEEDED: Canadian Radio-television and Telecommunications Commission) to ask your opinions on a variety of topics related to the telecommunications and broadcast services you use, the impressions of the service you receive and your general attitudes towards the communications sectors in Canada.

This survey will only take around 15 minutes. Just to confirm are you 18 years of age or older?

Would you prefer to continue in English or French?

Bonjour, je m’appelle (NOM COMPLET) et j’appelle de la part d’Ipsos, une société indépendante d’études de marché. Nous menons un sondage pour le CRTC (SI NÉCESSAIRE : Conseil de la radiodiffusion et des télécommunications canadiennes) pour vous demander votre avis à propos de divers sujets liés aux services de télécommunications et de diffusion que vous utilisez, vos impressions sur le service que vous recevez et vos attitudes générales envers les secteurs des communications au Canada.

Il ne vous faudra que 15 minutes environ pour répondre au sondage. Seulement pour confirmer, avez-vous 18 ans ou plus?

Préférez-vous continuer en français ou en anglais?

1 – Continue (English or French)

1 – Continuer (en français ou en anglais)

2 – French Callback

2 – Appel ultérieur en français

3 – English Callback

3 – Appel ultérieur en anglais

Your participation is voluntary and completely confidential. Your answers will remain anonymous. The information you provide will be used for research purposes only and will be administered according to the requirements of the Privacy Act, the Access to Information Act, and any other pertinent legislation.

(IF NEEDED: Should you wish to verify the credibility of this survey, you can utilize the Canadian Research Insights Council (CRIC) Research Verification Service by clicking here and entering the following project code: 20240220-IP036 If you have any questions about how to complete the survey or encountered any technical issues, please email Meghan.Miller@ipsos.com)

Votre participation est volontaire et entièrement confidentielle. Vos réponses demeureront anonymes. Les informations que vous fournissez seront utilisées à des fins de recherche uniquement et gérées conformément aux exigences de la Loi sur la protection des renseignements personnels, de la Loi sur l’accès à l’information et de toute autre législation pertinente.

(SI NÉCESSAIRE : Si vous souhaitez vérifier la crédibilité de ce sondage, vous pouvez utiliser le service de vérification de recherche du Conseil de recherche et d’intelligence marketing canadien [CRIC] en cliquant ici et en entrant le code de projet suivant : 20240220-IP036 Si vous avez des questions concernant la manière de répondre au sondage ou si vous éprouvez des problèmes techniques, veuillez faire parvenir un courriel à Meghan.Miller@ipsos.com)

Screeners

S1. As we are looking to speak to a broad cross-section of the public could you please let me know in which month and year were born.

S1. Étant donné que nous cherchons à parler à un large éventail de publics, pourriez-vous s'il vous plaît me dire votre mois et votre année de naissance?

January – December

Janvier à décembre

1910 – 2015

[IF LESS THAN 18 YEARS OLD, THANK YOU AND TERMINATE]

[IF S1 = DK/ REF ASK S1A, OTHERWISE SKIP TO S4]

S1a. Which of the following age ranges do you fall into? (INTERVIEWER: READ LIST UNTIL INTERUPTED. )

S1a. À laquelle des tranches d'âge suivantes appartenez-vous? (INTERVIEWEUR : LIRE LA LISTE JUSQU'À INTERRUPTION. )

18-24

18 à 24 ans

25-34

25 à 34 ans

35-44

35 à 44 ans

45-54

45 à 54 ans

55-64

55 à 64 ans

65 years or older

65 ans ou plus

[HIDDEN VARIABLE- AGE QUOTAS]

18-24 years

25-34 years

35-44 years

45-54 years

55-64 years

65 years or older

[GENDER- BY OBSERVATION]

S4. In which province or territory do you live? (DO NOT READ LIST, ACCEPT ONE RESPONSE)

S4. Dans quelle province ou quel territoire habitez-vous? (NE PAS LIRE LA LISTE, ACCEPTER UNE SEULE RÉPONSE)

[SINGLE PUNCH]

Alberta

Alberta

British Columbia

Colombie-Britannique

Manitoba

Manitoba

New Brunswick

Nouveau-Brunswick

Newfoundland and Labrador

Terre-Neuve-et-Labrador

Nova Scotia

Nouvelle-Écosse

Northwest Territories

Territoires du Nord-Ouest

Nunavut

Nunavut

Ontario

Ontario

Prince Edward Island

Île-du-Prince-Édouard

Quebec

Québec

Saskatchewan

Saskatchewan

Yukon

Yukon

[PROGAMMER: SET REGIONAL QUOTA FROM S4, IF DK/REF SET BASED ON SAMPLE VALUE]

Provider Classification

1. Which of the following telecommunications and television services do you currently have for your personal use? (READ LIST, ACCEPT ALL THAT APPLY)

Parmi les services de télécommunication et de télévision suivants, lesquels utilisez-vous actuellement à des fins personnelles? (LIRE LA LISTE, ACCEPTER TOUTES LES RÉPONSES QUI S'APPLIQUENT)

[MULTIPUNCH]

Cellphone

Téléphone cellulaire

Internet at home

Internet à la maison

Cable TV Service (IF NECESSARY: including Fibre Optic TV also known as IPTV or TELCO TV)

Service de télévision par câble (SI NÉCESSAIRE : y compris la télévision par fibre optique, également appelée télé IP ou télé TELCO)

Satellite TV Service

Service de télévision par satellite

Free television via an Antenna or converter set-top box (IF NECESSARY: e.g.: Roof-top antenna or aerial, rabbit or bunny ears or antenna built into TV set or a special converter set-top box)

Télévision gratuite avec une antenne ou un boîtier décodeur numérique (SI NÉCESSAIRE : p. ex. : antenne ou antenne de toit, antenne lapin ou oreilles de lapin, ou antenne intégrée au téléviseur ou un boîtier décodeur numérique particulier)

None of the above [MUTUALLY EXCLUSIVE][DO NOT READ]

Aucune de ces réponses [MUTUALLY EXCLUSIVE][DO NOT READ]

[IF SELECTED 'Cable TV Service' AT Q1 ASK Q2, OTHERWISE SKIP]

2. Which company provides your Cable TV Service? (DO NOT READ, ACCEPT ONE RESPONSE)

Quelle entreprise vous fournit un service de télévision par câble? (NE PAS LIRE, ACCEPTER UNE SEULE RÉPONSE)

Access Communications

Access Communications

AEBC

AEBC

Aliant/ Bell Aliant

Aliant/ Bell Aliant

ATOP

ATOP

Aurora Cable

Aurora Cable

Bell Fibe TV

Bell Fibe TV

Bell Alt TV

Alt Télé de Bell

Hay Communications

Hay Communications

Câblevision du Nord de Québec

Câblevision du Nord de Québec

Commstream

Commstream

Comwave

Comwave

Cogeco

Cogeco

Delta Cable Communications

Delta Cable Communications

EastLink

EastLink

EBox

EBox

Helix by Videotron

Helix de Vidéotron

MTS TV (Manitoba Tel/Manitoba Telecom Service)

MTS TV (Manitoba Tel/Manitoba Telecom Service)

Northwestel Fibre Optic TV

Télévision à fibre optique de Northwestel

Persona

Persona

Rogers Cable

Télévision par câble de Rogers

Rogers Ignite TV

Rogers Ignite TV

Sask Tel (Max TV, Max TV Stream)

Sask Tel (Max TV, Max TV Stream)

Seaside Cable Communications

Seaside Cable Communications

Shaw Cable

Shaw Cable

Shaw Blue Curve TV

Shaw Blue Curve TV

Source Cable Ltd.

Source Cable Ltd.

Teksavvy

Teksavvy

Telus

Telus

Vidéotron (Illico)

Vidéotron (Illico)

Westman Communications

Westman Communications

Vmedia

Vmedia

Virgin (Virgin TV Plus)

Virgin (Virgin TV Plus)

Dawson City TV

Dawson City TV

Northwestel Cable TV

Télévision par câble de Northwestel

Other

Autre

[IF SELECTED 'Satellite TV Service' AT Q1 ASK Q3, OTHERWISE SKIP]

3. Which company provides your Satellite TV Service? (DO NOT READ LIST, ACCEPT ONE RESPONSE)

Quelle entreprise vous fournit un service de télévision par satellite? (NE PAS LIRE LA LISTE, ACCEPTER UNE SEULE RÉPONSE)

Bell Satellite TV/ (formerly Bell ExpressVu)

Bell Télé Satellite (anciennement Bell ExpressVu)

DirecTV (U.S.)

DirecTV (É.-U.)

EchoStar (Dish Network) (U.S.)

EchoStar (Dish Network) (É.-U.)

ExpressVu

ExpressVu

Shaw Direct / Shaw Satellite TV

Shaw Direct/Shaw Satellite TV

Star Choice (now called Shaw Direct)

Star Choice (maintenant appelée Shaw Direct)

Telus Satellite TV

Telus Satellite TV

Other

Autre

[IF SELECTED 'Internet at home' AT Q1 ASK Q4, OTHERWISE SKIP]

4. Which company provides your home Internet connection? (DO NOT READ LIST, ACCEPT ONE RESPONSE)

Quelle entreprise fournit votre connexion Internet à domicile? (NE PAS LIRE LA LISTE, ACCEPTER UNE SEULE RÉPONSE)

Access Communications

Access Communications

Aliant (Bell Aliant)

Aliant (Bell Aliant)

Bell Canada (Accept Bell or Sympatico)

Bell Canada (accepter Bell ou Sympatico)

Cogeco

Cogeco

Distributel

Distributel

EastLink

EastLink

Manitoba Telecom Services (MTS)

Manitoba Telecom Services (MTS)

NorthernTel

NorthernTel

Primus

Primus

Rogers /Rogers Yahoo

Rogers /Rogers Yahoo

SaskTel

SaskTel

Shaw

Shaw

Starlink

Starlink

TekSavvy

TekSavvy

Telus

Telus

University/College

Université/cégep

Vidéotron/Illico/Helix

Vidéotron/Illico/Helix

Explorenet (Xplorenet)

Explorenet (Xplorenet)

Télébec

Télébec

Fido

Fido

Virgin

Virgin

eBox

eBox

Fizz

Fizz

Freedom

Freedom

Northwestel

Northwestel

Galaxy

Galaxy

SSi Canada

SSi Canada

Vmedia

Vmedia

Other

Autre

[IF SELECTED 'Cellphone' AT Q1 ASK Q5, OTHERWISE SKIP]

5. Which company provides your cellphone service? (DO NOT READ LIST, ACCEPT ONE RESPONSE)

Quelle entreprise vous fournit vos services de téléphonie mobile? (NE PAS LIRE LA LISTE, ACCEPTER UNE SEULE RÉPONSE)

Aliant Mobility

Aliant Mobility

Bell Mobility

Bell Mobilité

Fido

Fido

Koodo Mobile

Koodo Mobile

MTS Mobility

MTS Mobility

PC Mobility (Presidents Choice)

PC Mobile (Le Choix du Président)

Public Mobile

Public Mobile

Rogers Wireless

Rogers Sans-fil

SaskTel Mobility

SaskTel Mobility

Telus Mobility

Telus Mobilité

Videotron

Vidéotron

Virgin Mobile

Virgin Mobile

Freedom Mobile (formerly Wind)

Freedom Mobile (anciennement Wind)

Eastlink

Eastlink

Chatr

Chatr

Lucky Mobile (formerly Solo)

Lucky Mobile (anciennement Solo)

Thunder Bay Tel/TBay Tel

Thunder Bay Tel/TBay Tel

Fizz

Fizz

Shaw Mobile

Shaw Mobile

Ice Wireless

Ice Wireless

Knet Mobile

Knet Mobile

Sogetel Mobilité

Sogetel Mobilité

SSi Mobile

SSi Mobile

TbayTel Mobilit

TbayTel Mobility

Xplore Mobile

Xplore Mobile

Other

Autre

6. What video streaming services do you currently subscribe or have access to? (DO NOT READ LIST, CLARIFY FROM LIST IF NEEDED)

À quels services de diffusion vidéo en continu êtes-vous actuellement abonné(e) ou auxquels avez-vous accès? (NE PAS LIRE LA LISTE, CLARIFIER À PARTIR DE LA LISTE SI NÉCESSAIRE)

[MULTIPUNCH]

[RANDOMIZE]

Netflix

Netflix

Amazon Prime Video

Amazon Prime Video

CRAVE (with or without Movies, +HBO, Starz, or Super Ecran add-ons)

CRAVE (avec ou sans extensions Films, +HBO, Starz ou Super Écran)

Apple TV+

Apple TV+

Disney+

Disney+

YouTube Premium

YouTube Premium

Club Illico

Club Illico

Pluto

Pluto

Roku

Roku

Paramount+ Canada

Paramount+ Canada

tou.tv Extra

tou.tv Extra

BritBox

BritBox

CBC Gem

CBC Gem

Sportsnet Now

Sportsnet Now

DAZN

DAZN

TSN+/ RDS

TSN+/ RDS

None of the above [MUTUALLY EXCLUSIVE]

Aucune de ces réponses [MUTUALLY EXCLUSIVE]

7. What audio streaming services do you currently subscribe or have access to(DO NOT READ LIST, CLARIFY FROM LIST IF NEEDED)

À quels services de diffusion audio en continu êtes-vous actuellement abonné(e) ou auxquels avez-vous accès? (NE PAS LIRE LA LISTE, CLARIFIER À PARTIR DE LA LISTE SI NÉCESSAIRE)

[MULTIPUNCH]

Spotify

Spotify

Apple Music

Apple Music

YouTube Premium/YouTube Music

YouTube Premium/YouTube Music

Soundcloud Go+

Soundcloud Go+

Amazon Music

Amazon Music

SiriusXM

SiriusXM

Tidal

Tidal

Deezer

Deezer

Audible

Audible

Shazam

Shazam

None of the above [MUTUALLY EXCLUSIVE]

Aucune de ces réponses [MUTUALLY EXCLUSIVE]

Sentiment towards Provider(s)

14. How confident or not are you that you and your household will be able to pay for your telecommunications, television, audio and/or video subscription services without making any changes in the next three months? Using a scale from 1 to 10, where 1 is not at all confident and 10 is very confident.