Image Description

Paul Kovacs, Executive Director

Institute for Catastrophic Loss Reduction

Supplier Name: Institute for Catastrophic Loss Reduction

Contract Number: CW2305027

Contract Value: $39,550.00

Contract Award Date: May 9, 2023

Delivery Date: January 31, 2024

Registration Number: POR 007-23

For more information on this report, please contact Public Safety Canada at:

ps.communications-communications.sp@canada.ca

Prepared for Public Safety Canada

Supplier: Institute for Catastrophic Loss Reduction

Registration Number: POR 007-23

The reproduction of this publication is permitted for personal or public non-commercial purposes. For all other uses, prior written permission must be obtained from Public Safety Canada. For more information on this report, please contact Public Safety Canada at: ps.communications-communications.sp@canada.ca

Catalogue Number:

PS9-33/2024E-PDF

International Standard Book Number (ISBN):

978-0-660-70593-4

© His Majesty the King in Right of Canada, as represented by the Minister of Public Safety, 2024

I hereby certify as Executive Director of the Institute for Catastrophic Loss Reduction that the deliverables fully comply with the Government of Canada political neutrality requirements outlined in the Policy on Communications and Federal Identity and the Directive on the Management of Communications. Specifically, the deliverables do not include information on electoral voting intentions, political party preferences, standings with the electorate, or ratings of the performance of a political party or its leaders.

Signed:

Paul Kovacs, Executive Director

Institute for Catastrophic Loss Reduction

Paul Kovacs, Executive Director

Institute for Catastrophic Loss Reduction

Research purpose and objectives. Canada experiences large and exponentially growing flood losses. The federal government has at least four policy options to manage losses, plus the do-nothing alternative:

This research has three objectives:

Key findings. The research produced five key findings.

Methodology. ICLR commissioned an online survey of 3,000 adult Canadian homeowners’ willingness to pay for flood insurance. The study ran in field from July 27, 2023, to August 29, 2023. The 10-minute survey instructed respondents to assume they faced extreme flood risk. Using the Gabor-Granger method, respondents were shown a price scenario and asked whether they would purchase insurance. If they responded yes, they were asked if they would pay a given higher price. If they said no, the subsequent price shown was lower. Survey data were analyzed to produce curves of take-up rate versus price and other conditions such as opt-in versus opt-out framing.

Extrapolation to a broader audience. The survey size is large enough to infer the behavior of any large group of adult Canadian homeowners. The survey sample was approximately 1,000 respondents for opt-in and opt-out cases and approximately 500 respondents for buyout and combined-insurance cases. Associated margins of error are therefore 3.1% and 4.4%, respectively. Results are not weighted by respondent characteristics, but respondent attributes reasonably match the adult Canadian population distribution in income, age, gender, province, and First Nations, Métis, or Inuk identity. The authors make no assertions about its implications for others, such as renters, commercial and institutional property owners, or non-Canadians.

How the study could be used. The authors offer this information to inform government policy decisions about how to manage risk of flooding among the 1% of homeowners at extreme flood risk, especially policies regarding flood insurance, disaster financial assistance, and modifications to reduce flood risk.

Contract value. The cost for this work is $35,000 plus HST.

Natural disasters are increasing in frequency and severity. Flooding is Canada’s most common and costly disaster. The Disaster Financial Assistance Arrangements, administered by Public Safety Canada, provide financial assistance to provinces and territories that have experienced a large-scale natural disaster. Since the inception of the program in 1970, the Government of Canada has paid more than $8 billion in post-disaster funding to provinces and territories, and flooding has accounted for the vast majority (approximately 78%) of those payments.Footnote1

Considering the growing threat to Canadians’ safety from climate change and continued urbanization in high-risk flood areas, the Government of Canada is moving forward with several measures to help Canadians reduce their financial and physical vulnerability to flooding. Among these measures, the Prime Minister instructed the Minister of Emergency Preparedness and President of the King’s Privy Council for Canada to create a low-cost national flood insurance program to protect homeowners who are at high risk of flooding and do not have adequate insurance protection. A Task Force on Flood Insurance and Relocation (hereafter, the Task Force) was stood up to prepare a public report on the project’s findings; the report was made available to the public in Summer 2022. The Task Force’s work is being used to develop policy recommendations related to flood insurance and flood risk reduction.

Flood insurance can be an important tool for managing flood risk. Insurance can be an efficient means to finance household recovery, create a price signal that deters risky choices while encouraging protective behaviour, and promote the sharing of risk and responsibility between homeowners, governments, and the private sector. Flood insurance has been made available in countries that share similar political and socio-economic contexts as Canada. However, a made-in-Canada approach is needed to align policies within contextual characteristics of the Canadian federation such as its laws, regulations, constitutional responsibilities, emergency management policy perspectives, social fabric, and values.

Canadian insurers introduced residential flood insurance in 2016. By 2023, most homes (about 10 million out of 15 million total) had overland flood insurance protection (CatIQ, 2023). However, almost all these homes face low flood risk and account for 5-10% of the expected residential flood damage. Very few homes at high or extreme risk of flooding are presently covered by flood insurance, yet they account for the vast majority (90-95%) of the residential flood damage risk in Canada (Task Force on Flood Insurance and Relocation, 2022).

The Institute for Catastrophic Loss Reduction (ICLR) research team gratefully acknowledges funding provided in 2023 by Public Safety Canada for this study (phase 3) and funding provided in 2022 by the Insurance Bureau of Canada for research completed in phase 1 and 2. ICLR will fund a dissemination phase. The views and opinions presented here are those of the authors, and do not necessarily reflect the views or positions of Public Safety Canada and the Insurance Bureau of Canada.

The methodology applied here builds on research by Prof. Paul Kovacs and Dr. Bohan Li of ICLR; Dr. Howard Kunreuther and Dr. Lynn Connell-Price of the Wharton Risk Management and Decision Processes Centre; and Dr. Katsuichiro Goda of Western University to assess willingness to purchase earthquake insurance. In particular, the present authors adopted a research methodology developed by Kunreuther and Connell-Price to measure consumer willingness to pay for earthquake insurance.

To support the design and implementation of a national flood insurance program, specifically as it relates to increasing homeowner participation in areas with extreme flood risk, Public Safety Canada commissioned the ICLR to provide behavioural and economic insights into the important considerations that affect the willingness of a homeowner to participate in a flood insurance program. This study will assess homeowner willingness to purchase residential flood insurance products under various hypothetical scenarios. This will include an assessment of how the endowment effect (explained later) affects participation through an examination of opt-in or opt-out framing.

This research constitutes the third phase of a four-phase project funded by Public Safety Canada in partnership with the Insurance Bureau of Canada and ICLR. Phase 1 focused on homeowners at low to moderate risk of flood damages. Phase 2 focused on homeowners at high, but not extreme risk. These two phases were funded by the Insurance Bureau of Canada and completed in the fall of 2022. The third phase [this report], funded by Public Safety Canada, focuses on homeowners at extreme risk where relocation may be considered and was completed in 2023.

This third phase of work aligns with Public Safety Canada’s mandate letter commitment to create a low-cost national flood insurance program to protect homeowners who are at high risk of flooding and to examine options to relocate those at highest risk. This stand-alone report, outlining the findings from the third phase of work, has been prepared for Public Safety Canada and meets the requirements for public opinion research reporting as required by Library and Archives Canada.

Phase 4 of the project involves preparation of a public-facing report in 2024 that summarizes the research conducted as part of all phases of research. Costs associated with Phase 4 will be paid by ICLR, including preparation of the report, printing costs, distribution, and any webinars to share findings. The contributions of Public Safety Canada and the Insurance Bureau of Canada to fund the basic research will be acknowledged.

The research findings will contribute to the design of an insurance arrangement that considers the preferences and financial realities facing Canadians. An insurance product that considers the practicalities surrounding a homeowner’s willingness and ability to pay will enhance the number of people with flood insurance coverage. The more Canadians who are insured for flood-related damages, the less demand there will be for government-sponsored post-disaster financial assistance. No risks associated with the gathering of this data, or the dissemination of these results have been identified.

The purpose of this research was to develop behavioural and economic insights related to a homeowner’s willingness to purchase flood insurance at different price points under various hypothetical scenarios. The findings will inform the design and implementation of the national flood insurance program, specifically as it relates to increasing the participation of homeowners in areas with extreme flood risk.

The objectives of this research include:

Within this study, the research scenarios were focused on homeowners living in an area with an extreme risk of flood damage, defined as a 50% chance of flooding one or more times over the next ten years, to simulate the participants’ likelihood of purchasing flood insurance. The results were used to develop a demand curve and assess the price elasticity of demand. These findings will, in turn, inform policy decisions related to affordability and the development of strategies to enhance the uptake of flood insurance by households.

Leger is the largest Canadian-owned market research and analytics company. Leger Opinion (LEO) is the largest proprietary panel in Canada. The LEO community presently includes more than 400,000 members who complete surveys online to share their views and opinions. ICLR commissioned LEO to collect data through an online survey of 3,000 homeowners in the LEO community.

The survey targeted the public, specifically, adult Canadian homeowners. Respondents were asked about their willingness to pay for flood insurance and presented with the scenario of being at extreme risk of flood damage. That is, the survey instructed respondents to assume they live in a place with extreme flood risk. The survey did not exclusively select respondents who lived in a place with extreme flood risk, because that would have been too costly and problematic.

To participate in the survey, respondents had to be over 18 years of age. They had to read and confirm their understanding regarding confidentiality and risks of participation. They had to consent to participate in the research. Screening questions ensured that respondents were of age, own their home, and reside within Canada. As a quality control measure, the survey included an attention check to ensure respondents were reading questions carefully.

Sample stratification variables included the respondent’s age, gender, experience with overland flooding, whether and what kind of insurance they currently hold, their risk tolerance, their total pre-tax household income, and their province or territory of residence. The full survey was expected to take respondents less than 10 minutes to complete.

The survey was conducted using the Gabor-Granger method (Gabor and Granger, 1966). Respondents were shown a scenario, and requested to answer whether they would purchase insurance at a given price. Each respondent was shown two successive prices for a total of three. If they responded that they would purchase insurance at the price, the subsequent price shown was higher. If the respondent indicated they would not purchase insurance at that price, the subsequent price shown was lower. The Gabor-Granger method is considered to produce more valid results for products which respondents are less familiar with than direct price methods and the Van Westendorp (1976) method. Presently, almost no Canadian homeowners at extreme risk of flooding have been offered flood insurance so the Gabor-Granger method is best suited to estimate a demand curve and the price elasticity of demand.

Modern decision science and behavioural economics research shows that opt-out framing can increase take-up rates and willingness to participate due to the endowment effect (Kahneman et al., 1990). The endowment effect holds that people assign a higher value to something they already possess than they would pay to acquire it. That matters here because it implies that homeowners would pay more for coverage that was included in their policy.

For each scenario, ICLR considered the effect of opt-out framing on the take-up rates for optional flood insurance coverage. Each respondent saw the opt-in or the opt-out framing, but not both. In addition to the primary questions, ICLR also included questions to allow for further investigations including age, province of residence, gender, household income, insurance and flood experience, and risk-taking preferences. Analysis of the survey data produced a demand curve and price elasticity of demand factor for each scenario. Multivariate logistic regression analysis was conducted to examine and control for the effects of respondent characteristics. The regression analysis was also used to test whether opt-out framing produces different take-up rates compared to opt-in framing for the voluntary flood insurance product. The analysis fits weights (also called regression coefficients) β to equation 1 by maximum a posteriori (MAP) estimation. In the equation, xi denote the independent variables, meaning the stratification variables discussed earlier.

Here, the equation gives a best estimate of f, the fraction of people in a group who would buy the insurance, as a function of the policy conditions and price, and the group's household income, age, and other attributes.

(1) See Appendix A for the wording of the questions to elicit the stratification variables. Appendix B provides a summary of respondent demographics and other stratification variables.

Decision science and behavioural economics suggests several critical findings may become evident and could be quantified through this research. Affirmation of these findings can support policy choices and refinement of the initial design of a flood insurance program:

Decades of experience consistently finds that the demand for any product is affected by the price. If the price falls, then more homeowners are expected to purchase flood insurance. If the price increases, then fewer homeowners are expected to purchase flood insurance. Food, prescription drugs, and tobacco are examples of products where price has a smaller impact on demand. Soft drinks, electronics, and clothing are examples where a change in price may significantly impact sales because consumers can readily switch to an alternative product. Flood insurance may be viewed as a necessary purchase for those at extreme risk, so demand may have a small relationship with price. Quantifying the impact of prices can support policies seeking to achieve specific participation goals.

Homeowner willingness to pay for flood insurance is expected to be low if they believe the risk of flooding is low. Homeowner willingness to pay for flood insurance is expected to be higher if they believe the risk of flooding is high or extreme. This study will measure the impact of knowledge of flood risk on willingness to pay. Unfortunately, many Canadians are not aware of their actual risk of flooding. Providing homeowners at extreme risk with information about their actual risk is expected to have a significant impact on the expected success of a flood insurance program.

The endowment effect says that people are willing to pay more to avoid giving something up than they would pay to acquire something. This is related to the status quo bias, which is a tendency to keep things the way they are relative to making change. Applied to flood insurance, we expect that more Canadian homeowners will choose not to opt-out of flood insurance if it is included as part of basic insurance than would choose to opt-in and add flood insurance if it is not included. Presently, Canadian homeowners are told that basic residential insurance covers a broad range of risks, but the risk of damage from flood is not covered unless it is added. Decision science suggests that including flood insurance in basic coverage, with the option to opt-out, would increase the number of homeowners that choose flood insurance protection relative to the number of homeowners that choose to opt-into coverage. This is the first research study seeking to demonstrate and quantify this expected behaviour.

In 1970, the Government of Canada introduced the Disaster Financial Assistance Arrangements, where up to 90% of funds given by the provincial and territorial governments to recover costs incurred by flooding and some other natural disasters can be recovered from the federal government (Public Safety Canada 2023). Accordingly, for more than 50 years Canadian homeowners experiencing flood damage have sought financial assistance from their provincial or territorial government, largely recovered from the federal government. These programs are not insurance, but assistance offered with caps and limits not typical in insurance protection. Homeowners who believe that the alternative of disaster assistance has been removed are expected to be more willing to pay for flood insurance than those that expect public assistance.

Private insurance companies offer flood protection to millions of homeowners with low or moderate risk of flooding because these homeowners have demonstrated that they are willing to pay more than the expected cost to the insurer. That is, insurers offer insurance only where it is profitable to do so. Most private insurers do not offer insurance coverage to homeowners at extreme risk because insurance companies expect that the homeowners’ willingness to pay will not be sufficient to cover the expected costs. Policy alternatives like elevating, protecting, and relocating may be better policy approaches than insurance for homes known to be at extreme risk of flooding.

Beyond assessing these five expected outcomes, the study also assessed the impact of seven control variables on the expected responses:

This is phase 3 of a pioneering study to measure the willingness of Canadian homeowners at extreme risk to pay for flood insurance, including research to measure the endowment effect. Survey respondents reasonably represent the Canadian homeowner population; see Appendix B for sample size, respondent demographics, and the margin of error. Demographic attributes do not appear to significantly affect responses, as discussed later.

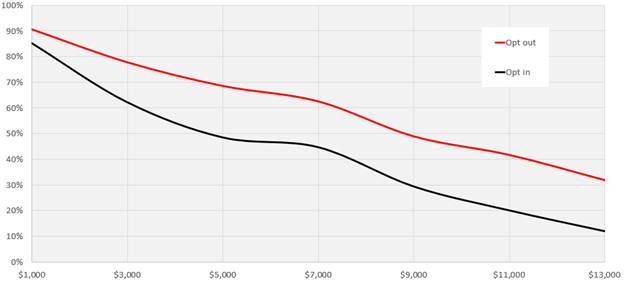

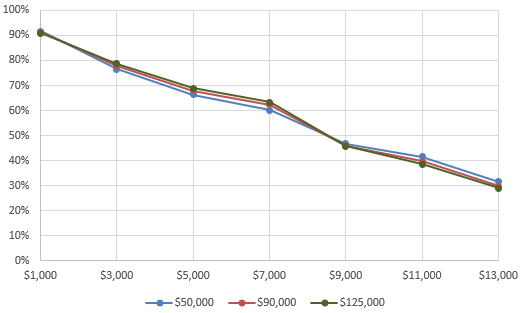

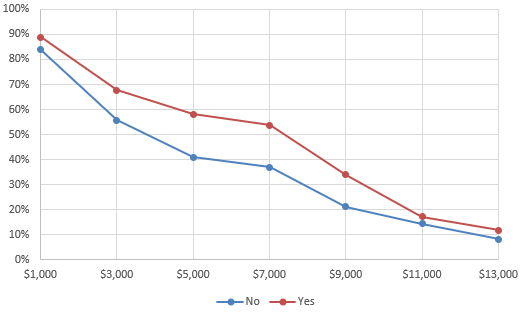

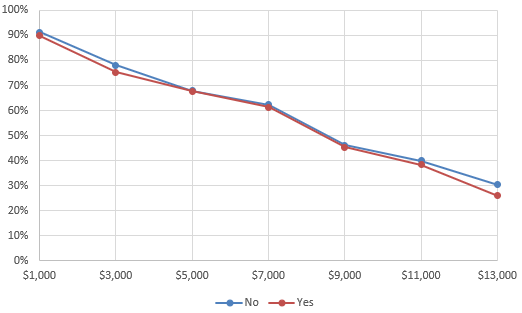

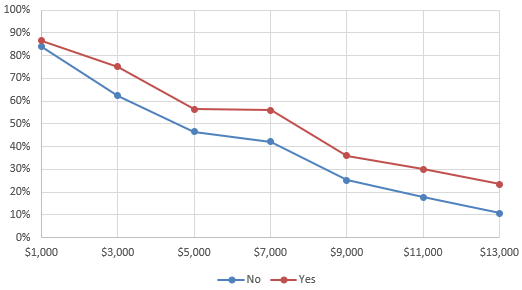

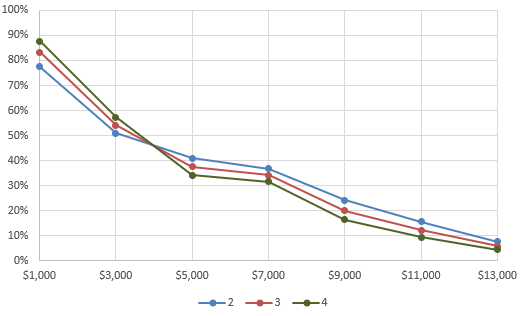

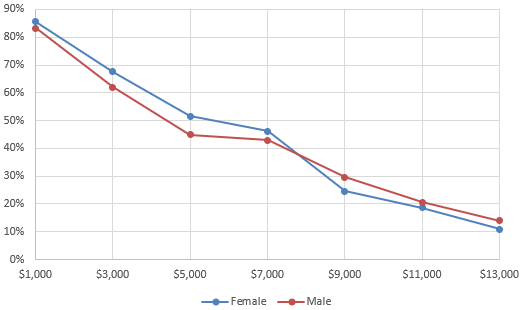

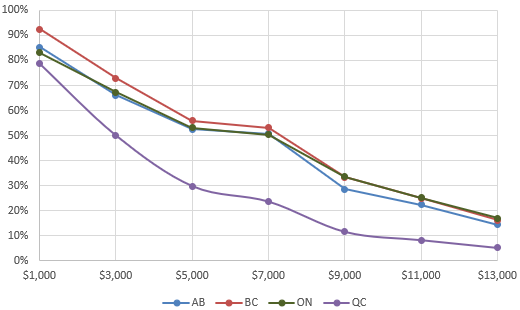

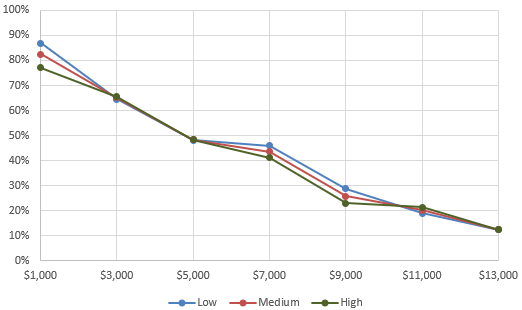

The regression showed that, for example, more than 60% of homeowners informed that they are at extreme risk of flood damage indicate that they would be willing to pay $3,000 a year to purchase flood insurance protection (see the black line in Figure 1). Almost 80% would not opt-out of flood insurance at $3,000 a year if it were included in basic coverage (see the red line in Figure 1).

Line graph showing average willingness to pay for homeowners at extreme flood risk, for both opt-in and opt-out based insurance programs, with premium prices raging from $1,000 to $13,000. Trend shows that homeowners become less willing to pay the more expensive the premium gets.

|

$13,000 |

$11,000 |

$9,000 |

$7,000 |

$5,000 |

$3,000 |

$1,000 |

|---|---|---|---|---|---|---|---|

Opt in |

12% |

20% |

29% |

45% |

48% |

62% |

85% |

Opt out |

32% |

42% |

49% |

63% |

69% |

78% |

91% |

While 78% would not opt-out at $3,000, 63% would not opt-out at $7,000, and 42% would not opt-out at $11,000 a year (see the red line in in Figure 1 ). Willingness to buy flood insurance is affected by the price, as anticipated, and now measured so it can support policy analysis.

These findings are based on a survey of 3,000 Canadians homeowners told to assume that they are at extreme risk of flood damage. Phase 1 research did not find any homeowners willing to pay $1,000 a year for flood insurance if told they are at low risk. Knowledge of risk is critical to willingness to pay.

Including flood protection with basic insurance coverage, with the option to opt-out (red in Figure 1 ), significantly increases to number of homeowners willing to participate with no change in coverage or price. Including flood insurance is a powerful policy tool to increase homeowner participation.

Respondents were told that government assistance would not be paid to those that opt-out.

The Task Force on Flood Insurance and Relocation found that it will cost several thousand dollars a year to provide flood insurance for homes at extreme risk. If homeowner willingness to pay is not sufficient to cover the expected cost, then the government must consider subsidies and other flood management practices that include elevating structures, protecting buildings, or relocation.

The survey of Canadian homeowners included questions to assess views about four policy actions:

“Do you agree Canadian governments should prohibit construction of new buildings in areas with high or extreme risk of flood where there is a greater than 10 percent chance of flooding over the next 10 years?”

Canadian homeowners support prohibition of construction in areas with high or extreme risk of damage. 59% strongly agree, 29% agree, 11% had no opinion or did not respond, 3% disagree, and 2% strongly disagree. This is an extraordinarily strong endorsement of federal, provincial, territorial, and local action to stop the creation of additional flood risk by prohibiting construction in designated zones where the risk of flooding is high or extreme.

“Do you agree that Canadians should pay $45 a year to support rebuilding of homes that experience flood damage in Canada?”

Most homeowners do not support providing a modest subsidy to support rebuilding homes that experience flood damage. 9% strongly agree, 21% agree, 24% had no opinion or did not respond, 19% disagree, and 28% strongly disagree. Some of the policy options presented in the report of the Task Force on Flood Insurance and Relocation explored subsidizing the purchase of flood insurance for those of high or extreme risk, but most homeowners appear to oppose financial supports for those at higher risk.

“Do you agree Canadian governments should offer to buy out, at a fair market price, the one percent of homes in areas with extreme risk of flood? These homes have 50 percent chance of flooding over the next 10 years and account for 34 percent of annual flood damage in Canada.”

Most homeowners support a voluntary buyout program for those at extreme risk of flooding when offered a fair market price. 22% strongly agree, 36% agree, 23% had no opinion or did not respond, 9% disagree, and 5% strongly disagree.

“Do you agree Canadian homeowners at extreme risk of flooding should be required to sell their home to governments at a fair market price?”

Most homeowners support a mandatory buyout program for those at extreme risk of flooding. 22% strongly agree, 32% agree, 25% had no opinion or did not respond, 10% disagree, and 5% strongly disagree.

ICLR requested that LEO select 3,000 Canadian homeowners at random. The survey instructed respondents to assume they faced extreme risk of flooding. Because of the cost, ICLR did not attempt to survey homeowners who were actually at extreme risk. The survey explained what extreme risk meant in terms of the likelihood of damage and cost of repair. The survey presented each respondent at random with one scenario and asked about their willingness to pay. See Appendix A for the English-language survey instrument.

Briefly, the survey told respondents to assume they have a home that would cost $500,000 to rebuild and replace contents if it were heavily damaged. Asking all homeowners to respond for a home of the same value allows the building of a demand curve for flood insurance across 3,000 respondents. We could not have constructed the demand curve if homeowners all considered their own homes, where much of the differences in responses would reflect differences in the value of the homes under consideration.

The study asked a random sample of homeowners if they would purchase flood insurance under a scenario where they were at extreme risk and if their home had a specific value. This study builds on the findings from phase 1 and phase 2 completed in 2022 where 4,500 Canadian homeowners were chosen by Leger and told to assume they were at low risk or high risk, and that they were in a home that would cost up to $500,000 to rebuild and replace the contents. The findings from the earlier study were consistent with available independent evidence showing the willingness of Canadians at low risk to pay for flood insurance, demonstrating the effectiveness of this approach to estimate willingness to pay.

The study used a modified Gabor-Granger pricing survey across seven price points. The survey presented each respondent with three prices, one at a time. If they indicate that they are willing to buy then the price goes up, if unwilling then the price goes down. This approach provides a better measure of willingness to pay for a product that is not familiar to the respondent than the alternative of asking what price they would pay. This recognizes that most homeowners at extreme risk of flooding are unfamiliar with flood insurance.

Respondents provided actual data for seven control variables (see Appendix B for response details):

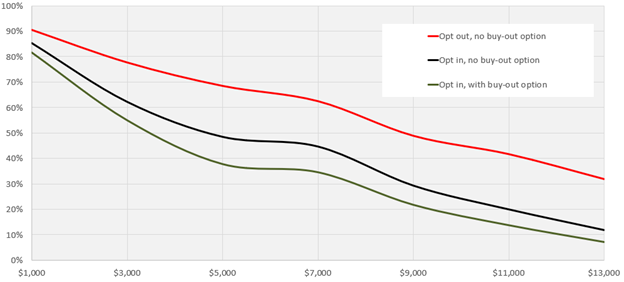

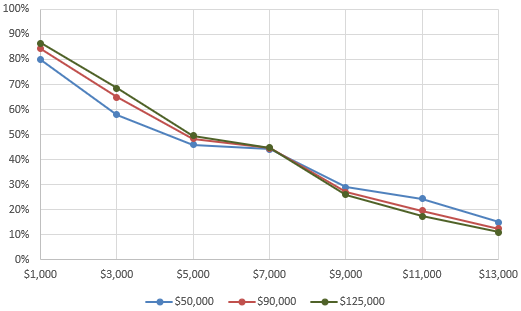

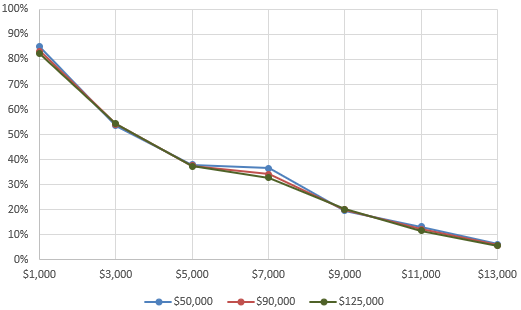

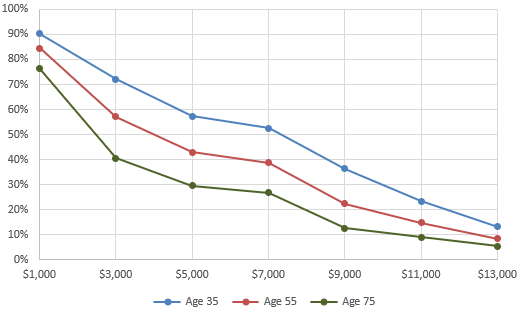

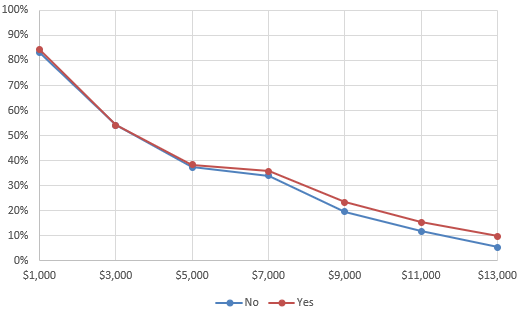

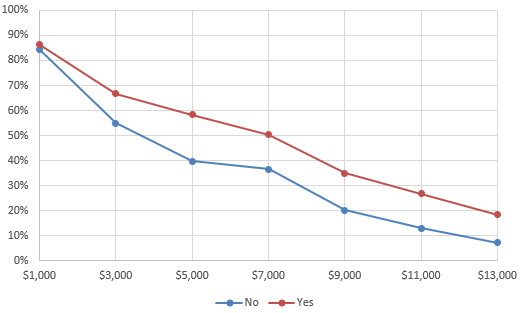

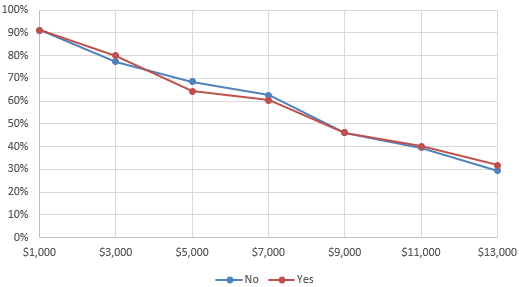

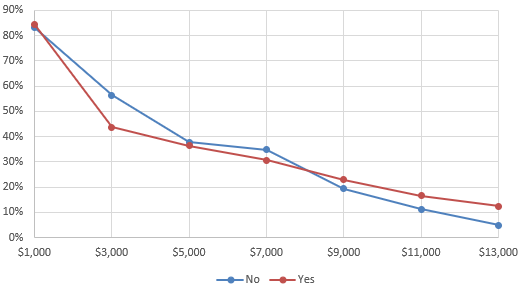

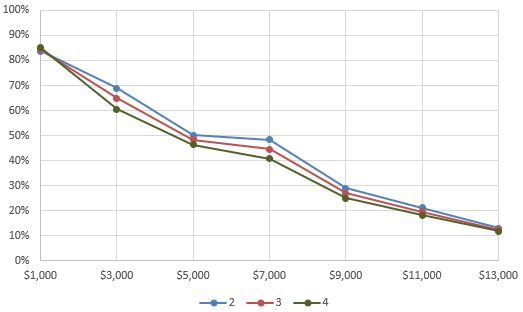

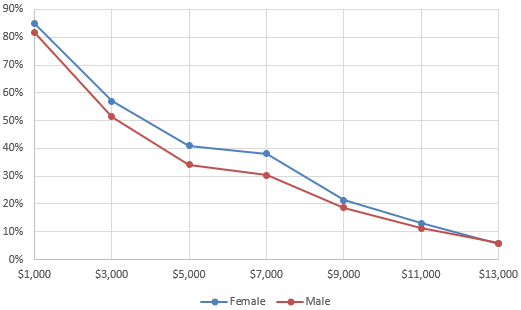

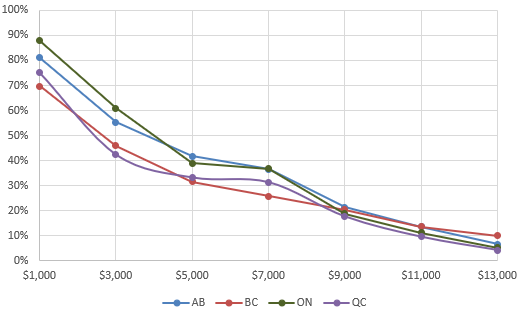

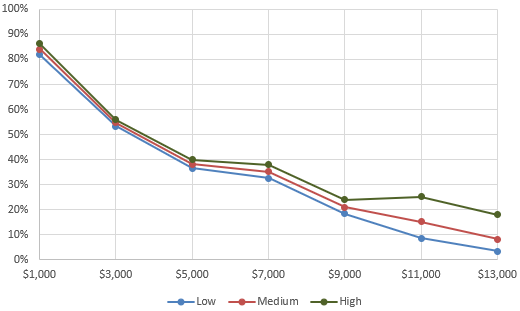

As one would expect, more respondents expressed a willingness to pay a lower price than to pay a higher price. Across several scenarios of opting in (the black line in Figure 2 ) or opting out (red in Figure 2 ), coverage with a buy out (green in Figure 2 ) or without a buy-out (black in Figure 2 ), every scenario found greater willingness to pay if the price is lower and a reduction in willingness if the price is higher. This finding is consistent with the expectation that price matters. Importantly, most homeowners informed that they are at extreme risk of recurring flooding say that they are willing to pay $1,000 to over $13,000 a year to participate in a flood insurance program.

Two surprises arose in the findings. First, the price elasticity is high: 85% of homeowners at extreme risk said they would pay $1,000 a year to add flood insurance. 48% said they would pay $5,000; 29% said they would pay $9,000; and 12% said they would pay $13,000 a year (shown in black in Figure 2 ). We anticipated that people at extreme risk would view flood insurance as a necessity and there may be minor impact of price on willingness to buy. We expected that homeowners at extreme risk might view insurance as a necessary purchase. That expectation now seems immaterial, given the lack of affordable insurance protection for those at extreme risk.

Second, flood insurance that offers a buy-out option is a superior product for homeowners than insurance that only provides repairs, but respondents were always willing to pay less for the buy-out option62% of homeowners at extreme risk said they would pay $3,000 a year to add flood insurance that does not include a buy-out option (the black line in Figure 2 ), and 55% would pay the same amount if a buy-out option is included (the green line in Figure 2 ). We believe this reflects an unwillingness of homeowners to consider the possibility that a flood could destroy their home. The only way to manage flood risk for these homes might be for the government to purchase and remove these homes.

Figure 2 reflects unconditional take-up rates, i.e., unweighted by respondent characteristics. Again, respondent demographics reasonably approximate the adult Canadian population in income, age, gender, province, and First Nations, Métis, or Inuk identity. See Appendix B for details.

Line graph showing average willingness to pay for homeowners at extreme flood risk, for 3 product design scenarios: opt-out with no buy-out option, opt-in with no buy-out option, and opt-in with a buy-out option. Premium pricing ranges from $1,000 to $13,000. Trend shows that the buy-out option is the least favourable and the opt-out is the most favourable, while homeowners become less willing to pay the more expensive the premium gets for all options.

|

$13,000 |

$11,000 |

$9,000 |

$7,000 |

$5,000 |

$3,000 |

$1,000 |

|---|---|---|---|---|---|---|---|

Opt in, no buy-out option |

12% |

20% |

29% |

45% |

48% |

62% |

85% |

Opt out, no buy-out option |

32% |

42% |

49% |

63% |

69% |

78% |

91% |

Opt in, with buy-out option |

7% |

14% |

22% |

35% |

38% |

55% |

82% |

Approximately 91 percent of homeowners told they are at extreme risk of flooding say they would not opt-out of paying $1,000 a year for flood insurance if it their homeowner policy included flood coverage, and 78 percent say they would pay $3,000 a year. The willingness to pay is much higher than those from the phase 1 study told they have low risk and the phase 2 study at high but not extreme risk. We do not believe that any of the homeowners at low risk would pay $1,000 or more a year for flood insurance. Perhaps 75% of homeowners at high risk would pay $1,000, but only 25% would pay $3,000. The only difference in the responses seems to reflect the awareness of the risk of flooding. Knowledge of extreme risk of flooding significantly increases willingness to pay for flood insurance, as predicted.

Extensive research shows that most Canadian homeowners at high and extreme risk of flooding do not know their actual risk. Discussion about providing a flood portal and other mechanisms to build flood awareness is critical to the success of a flood insurance program. Indeed, actions to improve awareness may be the single most important factor that will determine the success of a flood insurance program.

As predicted, including flood coverage with basic insurance significantly increases homeowner willingness to pay. Indeed, across scenarios, take-up increased by about 20 percentage points with no change in the price or the terms of coverage. For example, 48% of homeowners at extreme risk are willing to pay $5,000 to add flood insurance coverage, while almost 69% would not opt-out of coverage at the same price if basic coverage included flood insurance. The increase is consistent with the endowment effect findings of behavioural economics and decision science.

Mandating that insurance companies include flood insurance in basic coverage, with an option to opt-out, is a powerful mechanism to increase the number of homeowners that choose to buy flood insurance, while reducing the need for other financial incentives. A 20 percentage points increase in homeowners that participate in the program, with no financial cost, would help to achieve the goal of the government to significantly reduce the need for financial assistance.

The scenarios presented to Canadian homeowners consistently achieve higher participation in the flood insurance program than many people anticipated. In each scenario, the survey instrument told respondents to assume that they will get no financial assistance from government or claims payments from insurance companies if they choose to opt-out or choose not to opt-in to the flood insurance program. Removing the alternative of provincial and territorial disaster financial assistance is critical to the success of a flood insurance program.

We expect much lower willingness to pay for flood insurance if the program is introduced in competition with continuation of disaster financial assistance offered by provincial and territorial governments, which is largely funded by the federal government. Public assistance effectively serves as an alternative flood insurance program, with more caps and limits, offered free of charge. Respondent willingness to participate in a comprehensive flood insurance program requires removal of this alternative of public assistance that has been in place for more than 50 years.

The report of the Task Force on Flood Insurance and Relocationfinds that 90% of homes are at low or moderate risk of flooding, and account for about 9% of expected flood damage. About 9% of homes are high risk and account for 56% of expected damage. 1% of homes are at extreme risk, accounting for 34% of residential flood damage. Phase 1 of this study found that many homeowners at high risk are willing to pay more for flood cover than the expected cost. Phase 2 found that the majority at low risk are willing to pay more than the expected cost. However, it is likely that most homeowners at extreme risk will not be willing to pay the expected costs.

Participation could be increased by requiring coverage for all homeowners, or perhaps for all those with a mortgage. However, this would mandate participation by many homeowners that would not have voluntarily chosen to buy flood insurance. Financial incentives would increase voluntary participation, but the subsidies may need to be significant if participation were to increase meaningfully. Also, large deductibles, caps, and limits could be introduced to reduce the expected cost and required price, but this would introduce significant risk of underinsurance.

Flood insurance is important financial protection for 99% of homes at low or high risk but may not be the best solution for 1 percent of Canadian homes at extreme risk. Alternative, proven solutions for homes at extreme risk include:

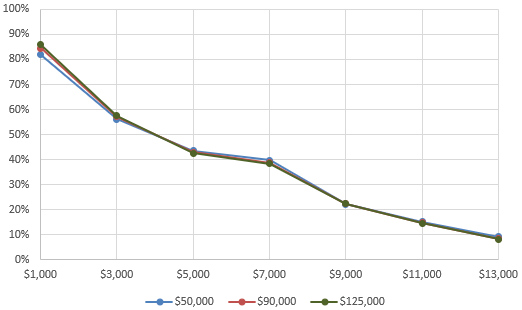

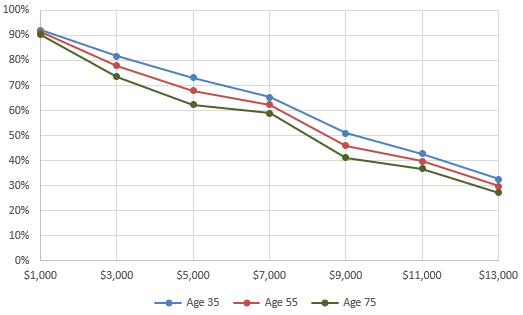

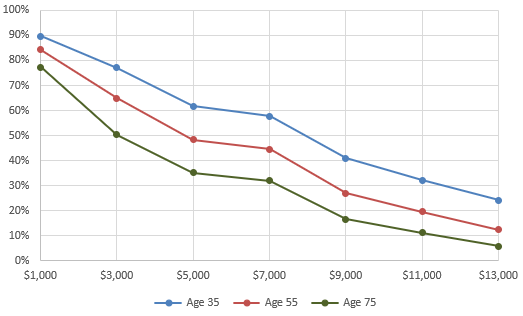

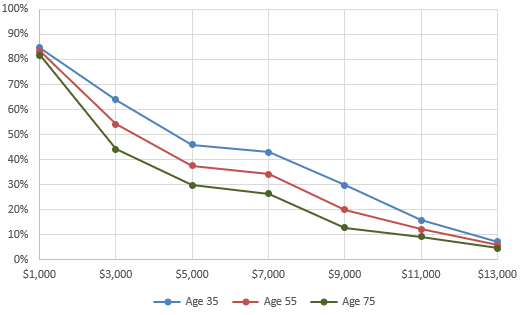

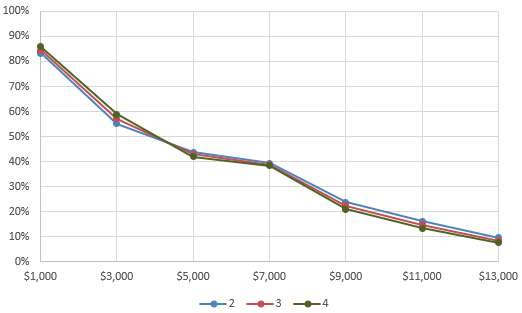

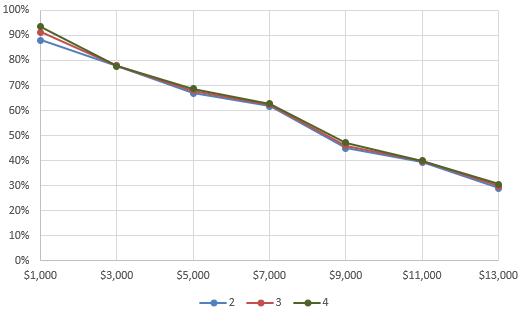

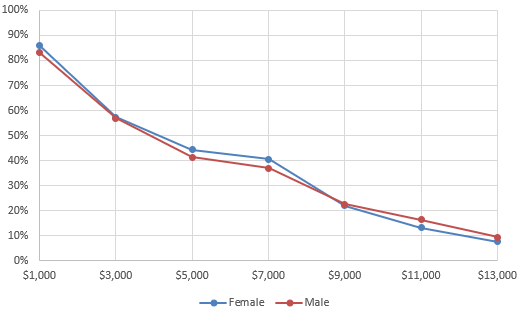

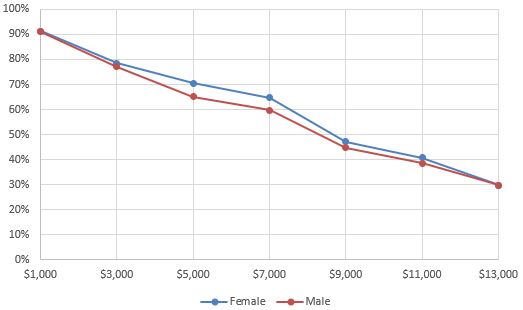

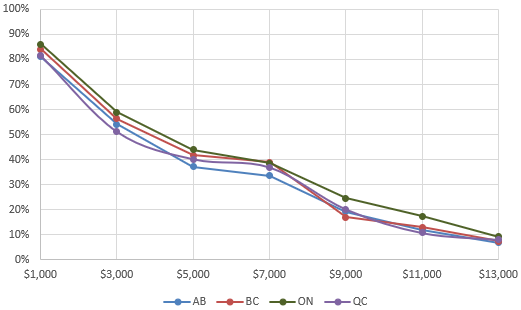

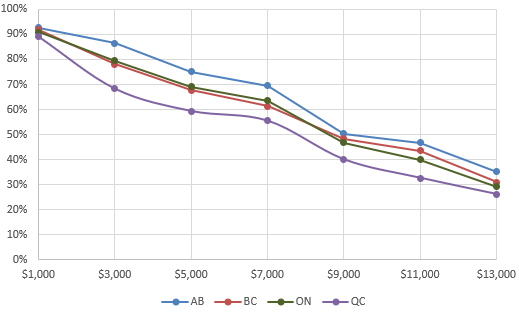

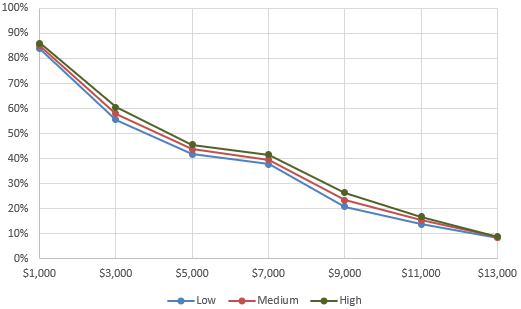

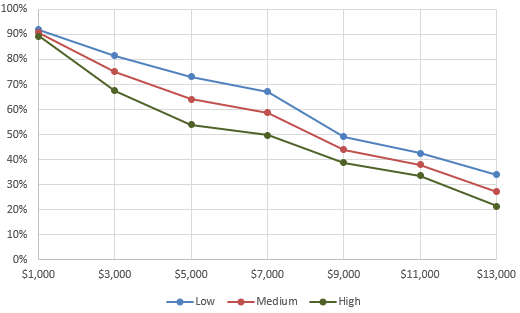

The authors assessed responses relative to seven control variables: age, gender, risk preference, family income, flood experience, insurance experience, and province/territory of residence. The primary overall finding was the absence of material effect of these demographic factors. Most differences were small and not statistically significant.

This study presents pioneering research applying decision science and behaviour economics findings to understand the willingness of Canadian homeowners to purchase flood insurance. This is the first study to assess and quantify consumer behaviour concepts, like opting out framing, for flood insurance.

In fall 2022, the ICLR research team presented Public Safety Canada and the Insurance Bureau of Canada with the results of a survey of 4,500 Canadian homeowners to assess their willingness to pay for flood insurance. This work focused on the 99% of homes at low or high risk, homes that the Task Force on Flood Insurance and Relocation found accounts for 65 percent of the expected residential flood damage in Canada. The research conducted in the present report, phase 3, was performed in 2023 and addresses the 1 percent of Canadian homes at extreme risk that the Task Force found account for 34 percent of residential flood damage.

This study measures the willingness of Canadian homeowners at extreme risk of flooding to pay for flood insurance. Consistent with phase 1 and phase 2 findings from the study of homeowners at low and high risk, the survey of 3,000 homeowners in this study indicated that:

Development of a national flood insurance program is an important policy initiative. The ICLR is pleased to contribute to this effort through an assessment of the willingness of Canadian homeowners to pay for flood insurance. Combined with the actuarial analysis of expected costs of residential flood damage by the Task Force on Flood Insurance and Relocation and others, measurement of homeowner demand provides additional information to help design an effective insurance program.

CatIQ (2023). Industry Exposure Database. Toronto, ON, https://public.catiq.com/products/ [accessed December 13, 2023]

Gabor, A., and Granger, C.W. (1966). Price as an Indicator of quality: Report on an enquiry. Economica, 33(129): 43-70, https://doi.org/10.2307/2552272 [accessed January 30, 2024]

Kahneman, D., Knetsch, J.L.; and Thaler, R.H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of Political Economy, 98 (6): 1325–1348. https://doi.org/10.1086/261737 [accessed January 30, 2024]

Public Safety Canada (2023). Disaster Financial Assistance Arrangements (DFAA). https://www.publicsafety.gc.ca/cnt/mrgnc-mngmnt/rcvr-dsstrs/dsstr-fnncl-ssstnc-rrngmnts/index-en.aspx [accessed January 30, 2024]

Statista (2023). Percentage of population using the internet in Canada from 2015 to 2023. Internet Penetration Canada. Statista Inc., New York, NY. https://www.statista.com/statistics/209104/internet-penetration-canada/ [accessed February 8, 2024]

Task Force on Flood Insurance and Relocation (2022). Adapting to Rising Flood Risk an Analysis of Insurance Solutions for Canada. Public Safety Canada, Ottawa, Ontario, 117 pp. https://www.publicsafety.gc.ca/cnt/rsrcs/pblctns/dptng-rsng-fld-rsk-2022/dptng-rsng-fld-rsk-2022-en.pdf [accessed January 30, 2024]

Van Westendorp, P.H. (1976). NSS Price Sensitivity Meter (PSM)–A new approach to study consumer perception of prices. In Proceedings of the 29th ESOMAR Congress, September 5-9, 1976, Venice, Italy

Note: text in square brackets is not shown to survey respondents. It serves as markers for survey logic.

Would you prefer to view this survey in English or French?

Préférez-vous répondre à cette enquête en français ou en anglais?

Thank you for your interest in participating in this research. The goal of this study is to understand how individuals make decisions relating to flood insurance. Flooding is a significant natural hazard in Canada and flood damage to homes is projected to increase. Your responses will be used to help design flood insurance products and other policies to improve protection against flood losses in Canada. It should take you less than 10 minutes to complete.

This survey was designed by researchers at the Institute for Catastrophic Loss Reduction at Western University. This research is sponsored by Public Safety Canada and the Insurance Bureau of Canada.

Please review the following information:

Your Participation is Voluntary

Your participation in this survey is voluntary. You may discontinue participation at any time during the survey by exiting the survey without consequence. Once you submit your survey, it will not be feasible to withdraw the data provided from the study.

Confidentiality and Risks of Participation

We will make every effort to keep all the information you provide us during the study strictly confidential, except as required by law. Your name and other directly identifying information will not be collected and only aggregated results will be reported, so no one will be able to identify you in any data or publications that result from this research. The information you provide will be administered according to the requirements of the Privacy Act, the Access to information Act, and any other pertinent legislation. View our privacy policy.

We do not expect there to be any foreseeable risks from participation in this survey. Delegated representatives of Western University and its Non-Medical Research Ethics Board may require access to your study-related records to monitor the conduct of the research.

Study Payment and Benefits

Beyond the payment you receive for survey completion through LEO, there will be no direct benefits of the study.

Questions

If you have questions regarding this research or your participation in it, please contact the researcher, Anuradha Maurya, at amaurya@iclr.org

Please confirm the statements below and click "Next" to proceed.

Yes |

No |

|

|---|---|---|

I am age 18 or older. |

||

I have read and understand the information above. |

||

I consent to participate in this research and want to continue with the task. |

What is your birth year?

Are you a renter or a homeowner?

In which country do you currently reside?

[dropdown list of countries]

What is your gender?

[display this question if country: Canada]

In which province or territory do you currently reside?

[dropdown list of provinces and territories]

[Survey ends if the participant does not meet the screening criteria]

On the next four pages, you will read about a hypothetical scenario and make decisions related to insurance. The information provided in the hypothetical scenario will not change, and it will be shown on each question.

Please read the information carefully and make your choices as you would if you faced the situation in real life.

This survey implements the Gabor-Granger methodology for pricing surveys. Survey respondents will be presented with one hypothetical flood risk scenario. They will then be asked if they would purchase the product at three successive price points, one on each page.

For the opt-in and bundling scenarios, if the respondent indicates they would purchase the product, the price shown on the next page increases. If the respondent indicates they would not purchase the product, the next price shown decreases.

For the opt-out scenario, if the respondent indicates they would remove the product, the price shown on the next page decreases. If the respondent indicates they would not remove the product, the next price shown increases.

Common elements across all scenarios

|

Parameter Value |

|---|---|

Home replacement cost |

$500,000 |

Homeowner’s insurance premium (theft, fire, wind) |

$1,000 |

Homeowner’s insurance deductible (theft, fire, wind) |

$500 |

Homeowner’s insurance limit |

Unlimited |

Flood risk scenarios

|

Extreme |

High |

Low |

|---|---|---|---|

Flood chance (10 years) |

50% (1-in-15) |

18% (1-in-50) |

2% (1-in-500) |

Average Losses Given Flood |

$60,000 |

$60,000 |

$20,000 |

Flood Deductible |

$5,000 |

$5,000 |

$5,000 |

Flood Limit |

$300,000 |

$300,000 |

$300,000 |

Flood premiums (annual) by flood risk scenario

| Price Pt. | -3 |

-2 |

-1 |

0 (start) |

+1 |

+2 |

+3 |

|---|---|---|---|---|---|---|---|

Extreme |

$1,000 |

$3,000 |

$5,000 |

$7,000 |

$9,000 |

$11,000 |

$13,000 |

High |

$250 |

$500 |

$750 |

$1,000 |

$1,250 |

$1,500 |

$2,000 |

Low |

$25 |

$50 |

$75 |

$100 |

$125 |

$150 |

$200 |

Each respondent is shown three prices, each on a separate page.

The first price shown is the +0 price.

The second price shown would be:

The third price shown would be:

Survey Questions

Below are the questions for one flood risk scenario (extreme risk). For each flood risk scenario, we will have three presentation scenarios: opt-in flood coverage, opt-out flood coverage, and mandatory bundling of flood coverage. Each respondent will see only one flood risk scenario x presentation combination.

[Not shown to respondent: Case4 Extreme_optin C4 intro]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is a 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Page Break

[Not shown to respondent: C4 +0]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $7,000 per year to add flood insurance coverage to your home?

Page Break

[Not shown to respondent: C4 +2]

[display if C4 +0: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $11,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C4 -2]

[display if C4 +0: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $3,000 per year to add flood insurance coverage to your home?

Page Break

[Not shown to respondent: C4 +3]

[display if C4 +0: Yes AND C4 +2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $13,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C4 +1]

[display if C4 +0: Yes AND C4 +2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $9,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C4 -1]

[display if C4 +0: No AND C4 -2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $5,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C4 -3]

[display if C4 +0: No AND C4 -2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $1,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: Case5 Extreme_optout]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is a 50% chance that a flood will damage your home at least once over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You can choose to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Page Break

[Not shown to respondent: C5 +0]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is a 50% chance that a flood will damage your home at least once over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $8,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $7,000 per year on your premium?

Page Break

[Not shown to respondent: C5 -2]

[display if C5 +0: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $4,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $3,000 per year on your premium?

[Not shown to respondent: C5 +2]

[display if C5 +0: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $12,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $11,000 per year on your premium?

Page Break

[Not shown to respondent: C5 -3]

[display if C5 +0: Yes AND C5 -2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $2,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $1,000 per year on your premium?

[Not shown to respondent: C5 -1]

[display if C5 +0: Yes AND C5 -2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $6,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $5,000 per year on your premium?

[Not shown to respondent: C5 +1]

[display if C5 +0: No AND C5 +2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the choice to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $10,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $9,000 per year on your premium?

[Not shown to respondent: C5 +3]

[display if C5 +0: No AND C5 +2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing that covers losses from flood, theft, fire, and wind. If your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $300,000 of additional losses.

You are given the opportunity to remove coverage for flood losses to your home insurance.

If you remove flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Suppose your home insurance premium is $14,000 per year to cover flood, theft, fire, and wind losses. Would you remove flood insurance from your home insurance for a discount of $13,000 per year on your premium?

[Not shown to respondent: Case6 Extreme_optin buyout]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is a 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Page Break

[Not shown to respondent: C6 +0]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

I

f you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $7,000 per year to add flood insurance coverage to your home?

Page Break

[Not shown to respondent: C6 +2]

[display if C6 +0: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $11,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C6 -2]

[display if C6 +0: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $3,000 per year to add flood insurance coverage to your home?

Page Break

[Not shown to respondent: C6 +3]

[display if C6 +0: Yes AND C6 +2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $13,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C6 +1]

[display if C6 +0: Yes AND C6 +2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance (that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $9,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C6 -1]

[display if C6 +0: No AND C6 -2: Yes]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $5,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: C6 -3]

[display if C6 +0: No AND C6 -2: No]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

Suppose you have home insurance costing $1,000 per year that covers losses from theft, fire, and wind. Like most standard home insurance products in Canada, it does not cover flood damage.

You are given the opportunity to add coverage for flood losses to your home insurance.

If you add flood insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood.

If you do not purchase this additional flood insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood losses.

Would you pay an additional $1,000 per year to add flood insurance coverage to your home?

[Not shown to respondent: Case7 Extreme_optout buyout]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

You are given the opportunity to purchase home insurance that covers losses from flood, theft, fire, and wind. This is the only home insurance product available. Most standard home insurance products in Canada today does not cover flood damage.

If you buy insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If you experience flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood. If your house suffers theft, fire, or wind losses, you would be responsible for the first $500 of losses and insurance will cover the rest.

If you do not purchase this home insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood, theft, fire, or wind losses.

Page Break

[Not shown to respondent: C7 +0]

Hypothetical Scenario: Assume you own a home in your region that would cost $500,000 to rebuild and replace the contents if heavily damaged.

Your home faces extreme risk of flooding. There is an 50% chance that a flood will damage your home at least one or more times over the next 10 years. If a flood were to damage your home, the average cost to repair the damage is $60,000 (actual losses could be higher or lower).

You are given the opportunity to purchase home insurance that covers losses from flood, theft, fire, and wind. This is the only home insurance product available. Most standard home insurance products in Canada today does not cover flood damage.

If you buy insurance and your house suffers flood losses, you would be responsible for the first $5,000 of losses and insurance would cover up to $100,000 of additional losses. If your home experiences flood damage in excess of $100,000 you will be given the option to sell your home for $500,000, the estimated value of the home before the flood. If your house suffers theft, fire, or wind losses, you would be responsible for the first $500 of losses and insurance will cover the rest.

If you do not purchase this home insurance coverage, you will not receive any financial assistance from insurance companies or the government if your house suffers flood, theft, fire, or wind losses.

Would you pay $8,000 per year to buy this home insurance coverage for flood, theft, fire, and wind losses?

Page Break

[Not shown to respondent: C7 +2]

[display if C7 +0: Yes]